The board of Infrastructure Leasing & Financial Services (IL&FS) has called an emergency meeting in Mumbai on Friday to take a call on fundraising, sale of assets, including road projects, and default by its subsidiary IL&FS Financial Services (IFIN) on commercial paper. The board might even look at reducing the premium on shares because some shareholders were not happy with high premium, said a source close to the development.

The infrastructure financial institution is facing a strain on liquidity and debt overhang. On August 30, the IL&FS board had slashed the dividend payout for 2017-18 from Rs 6 a share to Rs 1 a share.

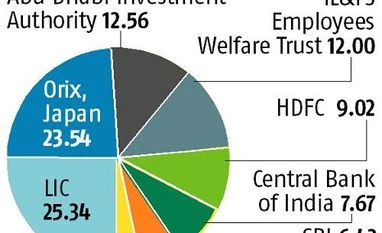

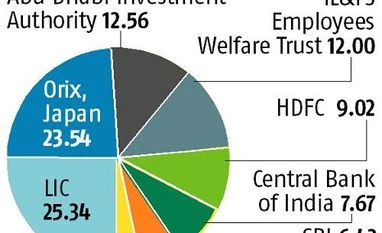

The IL&FS board comprises representatives of key shareholders such as Life Insurance Corporation (LIC), Orix Corporation of Japan, the Abu Dhabi Investment Authority, Central Bank of India, and State Bank of India.

The board plans to raise Rs 45 billion through a rights issue and up to Rs 50 billion through a public issue of non-convertible debentures. But some shareholders, including HDFC, were not keen to bail out IL&FS, and said they would not subscribe to the rights issue.

A source said that while LIC was willing to participate in the rights issue, it would require the insurance regulator’s approval if its stake was to go beyond the 25.34 per cent it held at the end of 2017-18. Another source said the board might look at reducing the premium on shares, given the recent decline in the share prices of the listed companies of the group. He also said a lower premium could make some of the reluctant investors subscribe to the issue.

The official concerned in the risk management department at Sidbi was asked to go on leave on the issue of proper assessment of risk on this exposure.

The IL&FS group plans to shed its overall debt by Rs 300 billion by divesting sale of 25 projects over 12-18 months.

Meanwhile, CARE Ratings cut the rating for another group entity IL&FS Energy Development Company’s loans and debentures from ‘A+’ to ‘BB-’ owing to deterioration in its liquidity profile. The company has delayed repaying term loans, according to the rating agency.

- Il& FS board may deleverage balance sheets of group entities

- Evaluate proposals for sale of road assets

- Fund infusion into IFIN on agenda

- Default to come up for discussion

)

)