IT results: Top 4 perform differently in March quarter

TCS, Infosys do well but Wipro & HCL disappoint analysts; however, outlook for FY17 bullish in general

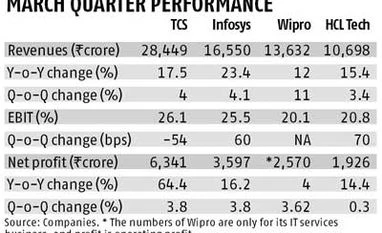

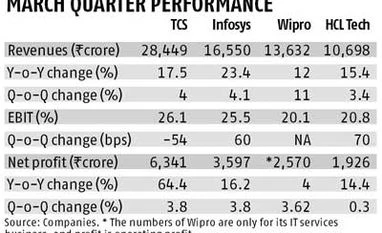

Shivani Shinde Nadhe Pune The results of the March quarter have shown further polarity in the performance of the top four information technology (IT) services companies.

The top two, Tata Consultancy Services (TCS) and Infosys, have reported better than expected numbers. Wipro and HCL Technologies' numbers were impacted on some company-specific issues.

After a stellar performance from TCS and Infosys, HCL's third quarter numbers (the company follows a July to June financial year) had revenue growth missing Street expectations, though better than Wipro's. Net profit was Rs 1,926 crore for the quarter, up 14.4 per cent over a year before and by 0.3 per cent sequentially (the earlier quarter). Revenue rose 15.4 per cent to Rs 10,698 crore, up 3.4 per cent from the earlier quarter.

What disappointed the Street was dollar revenue growth, at 1.3 per cent on a sequential basis, $1,587 million. Volume growth for the quarter at 1.7 per cent was also lower compared to the peers. The impact of the results was evident on the company’s stock price, down 4.5 per cent. Analysts are bothered that despite a healthy order book, revenue growth at the Noida-based company has been slow.

A look at HCL's year-on-year revenue change also hints at slowing growth. Revenue in constant currency for the quarter ended March at $1,612 mn grew 8.1 per cent over a year before; for the December quarter, revenue increased 9.3 per cent.

The March quarter is traditionally a weak one for the sector but both TCS and Infosys defied that and reported better than expected numbers. TCS reported volume growth of 3.2 per cent and Infosys of 2.4 per cent.

Similarly, a look at markets and vertical growth shows good growth traction at TCS and Infosys. America, the major market for the IT industry, grew 2.4 per cent for TCS and 0.5 per cent for Infosys. Europe, a bit slow on growth, grew well for both companies.

What remains consistent is management commentary that hints at strong growth in FY17. The confidence is shared by Moody’s Investor Services. It says Indian IT services will maintain global market share gains, supported by expanding coverage and operating efficiencies, albeit at a moderate pace.

“We expect Indian IT services companies to maintain market share gains while preserving their Ebitda (operating earnings) margins in the 21-22 per cent range,” said Kaustubh Chaubal, vice-president at Moody's.

This cannot be said about Wipro. The Bengaloru-based company continues to lag TCS and Infosys. The concern among analysts is growth from the core business, which “is not showing growth. Most of the revenue growth has come from acquisition”, says Sarabjit Kour Nangra, analyst at Angel Broking. “Having said that, Wipro’s growth issues are more company-specific and does not reflect growth momentum of the industry.”

However, even Wipro’s management sounded more bullish about future prospects, with chief executive Abidali Neemuchwala laying out a road map to reach annual revenue of $15 billion by 2020.

“There seems no reason or cause for worry on the FY17 outlook being subdued. However, the industry does not have control on macro issues like currency,” added Nangra.

Moody’s also cautions on growth due to currency volatility. “While the rupee has seen sustained depreciation against the dollar since April 2011, the latter is appreciating against other major currencies, leading to cross-currency volatility and conversion impact on growth estimates,” it said.

)

)