KKR, Blackstone eye stake in Idea

Private equity giants bidding for a total of 8% in India's third-largest telecom operator by subscriber base

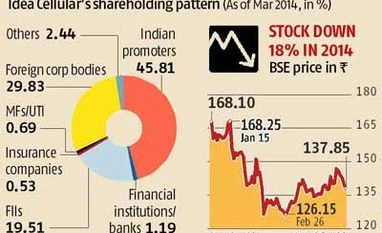

Joydeep GhoshKatya B Naidu Mumbai Two top private equity players — Kohlberg Kravis Roberts (KKR) and Blackstone — have put in bids for a total of eight per cent stake in Idea Cellular, India’s third-largest telecom operator by users.

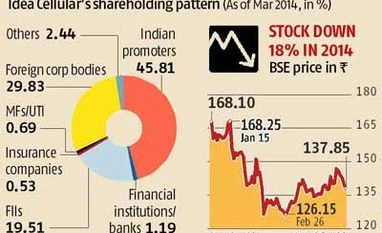

“The companies have put in bids at a decent premium to the prevailing stock price,” said an investment banker familiar with the developments. Shares of Idea on Wednesday closed at Rs 137.85 apiece, down 1.85 per cent from their previous close on the BSE.

While KKR India said it would not comment on the speculation, Blackstone and Idea did not respond to questionnaires sent by Business Standard on Monday.

Singapore’s state-owned investment company, Temasek, is also known to be looking to invest in a telecom company in India, though its involvement in the Idea deal could not be confirmed.

Idea is also trying to raise funds through a qualified institutional placement (QIP). It had come close to clinching a deal last September but that could not go through.

The company had taken an enabling resolution that it planned to raise as much as Rs 3,000 crore through QIP. Its largest investor, Malaysia’s telco Axiata, with a 19.9 per cent stake, has said it would invest as much as Rs 750 crore to maintain its stake in the company.

Idea’s financial performance has been stellar since the start of last financial year. It posted an 80 per cent increase in net profit for the last three quarters of FY14, following a reduction in free and promotional offers.

Idea’s data revenues have also increased in the past few quarters, in line with the industry growth due to an increase in 3G use.

Idea, an Aditya Birla Group company, has won the strong 900-MHz spectrum in the key Delhi circle and 4G spectrum across eight circles. The 65.2 MHz of spectrum it has acquired will help it expand 3G network in the country's capital and make its eight circles 4G-ready. The GSM operator will raise funds for the initial upfront payment through internal accruals and rebalancing of debt.

Last May, Qatar Endowment Fund invested $1.2 billion for a five per cent stake in Bharti Airtel.

Top telecom companies have been attracting investors despite the sector facing troubles for a few years. Competition in the sector has got reduced, with smaller players going out of business. Serious challengers among new telecom entrants like Uninor and Sistema Shyam, too, have been reduced to few-circle players and exited national play.

)

)