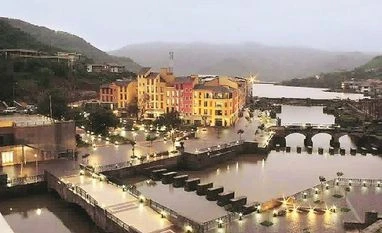

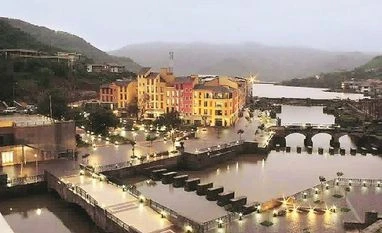

The lenders to Lavasa Corporation — the company developing a hill city near Pune — will invite fresh bids for the debt-laden firm and its 49 subsidiaries, after the National Company Law Tribunal (NCLT) decided to have a single consolidated resolution plan for all of them.

Lavasa and its subsidiaries defaulted on their debt obligations totalling about Rs 7,700 crore, which led the lenders to send the company to the NCLT for debt resolution in August 2018.

“All the previous bidders for Lavasa may not have the financial strength to take over Lavasa and its subsidiaries at the same time. Hence, the lenders have decided to call fresh bids from anyone who is interested in taking over the entire township along with its infrastructure,” said a source close to the development. Several companies had submitted offers for Lavasa as a standalone entity. These included Delhi-based food major Haldiram Snacks, Pune-based builder Aniruddha Deshpande, and UV Asset Reconstruction Company (UV ARC). Oberoi Realty and US-based fund Interups Inc also joined the race at a later stage.

The court was also told that due to the symbiotic relationship with the parent, several of Lavasa subsidiaries would lose their revenue streams. Hence it made sense to consolidate all resolution plans.

These companies were providing captive power to Lavasa, apart from running basic transport, maintaining and running the convention centre, and running retail operations on the premises of Lavasa Corporation. A separate company was operating a luxury hotel.

Therefore, the NCLT was of the opinion that the inter-linkages and synergies between these companies to keep Lavasa as a running township was important and, to achieve maximisation value for all the companies, it was imperative that all bidders made a single offer for these companies by way of a single offering.

Interestingly, the first set of three bidders had put “consolidation” as a precondition to the resolution plan. Therefore, it will be harder to find a resolution plan for any of these companies on a standalone basis if the supply and demand from the rest of the companies are not guaranteed. “However, if the group companies of LCL are resolved in a coordinated/consolidated manner, a much more value-maximising resolution could be achieved,” the NCLT said.

)

)