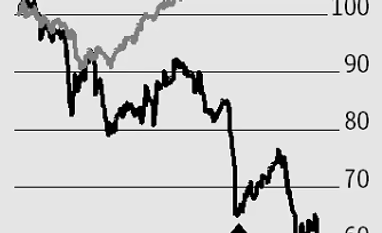

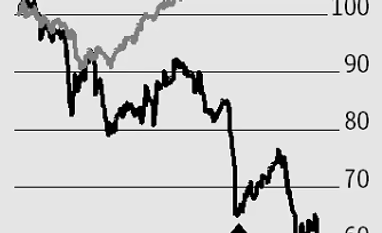

The Sun Pharmaceutical Industries stock shed nearly six per cent in two days and was the top loser among Sensex constituents, after brokerages cut their target prices, to reflect the worsening situation in the US and lack of triggers in other markets.

To add to its woes, there could be more downside for the stock.

CLSA, which has cut its target price to Rs 370, indicating a 22 per cent downside from the current level, believes the stock trades at an expensive 25 times of its FY19 earnings estimate and does not capture the concerns. Morgan Stanley, too, has an ‘underweight’ rating, with a target price of Rs 362.

While there have been steep cuts in FY18 and FY19 earnings per share (EPS) estimates after its disappointing June quarter performance, the price-to-earnings (P/E) ratio de-rating has been more gradual.

Further de-rating could come if the drug major’s plants, which are under the US Food and Drug Administration radar (Halol, Ranbaxy), do not get clearance soon or are required to take additional remedial measures, an analyst at a domestic brokerage said.

“Lack of compliant plants, especially Halol, (half of the key Abbreviated New Drug Applications) is the single biggest trigger. A worsening of this situation could lead to P/E de-rating all the way to 20 times one-year forward estimates,” the analyst added.

There are multiple reasons responsible for Sun Pharma’s current situation — lack of integration benefits after its merger with Ranbaxy, decline in market share across the product portfolio in the US market and lack of high-value products in the near term. The biggest impact for consolidated operations in the June quarter was on account of its US subsidiary, Taro.

“The steep price correction in many products, including the dermatology portfolio, led to a 30 per cent fall in revenue and 50 per cent fall in net profit for Taro Pharma in the June quarter. Given the high margin nature of these products, it had a significant impact on Sun Pharma’s consolidated operations,” said Ranjit Kapadia of Centrum Broking. Ex-Taro, revenue from Sun Pharma’s US operations have stabilised, analysts at CLSA said.

US sales for the trailing three months ended July indicate both Sun Pharma and Taro continue to face pressure, with prices declining 25-26 per cent year-on-year (y-o-y) during the period. As the recovery in US operations is at least a year away, the only bright spot for the pharma major could be a revival in its India sales, which in the June quarter were down five per cent y-o-y, impacted by the de-stocking ahead of the implementation of the goods and services tax.

As demand improves and restocking takes place, Sun Pharma’s domestic sales should improve. India is its second-largest market, contributing 26 per cent to consolidated sales. This is why India gets nearly double the enterprise value to sales multiple at 4.5 times, compared with the company’s US business multiple.

)

)