Motherson Sumi: New orders, utilisation to aid revenue growth, margins

While one-offs led to a dip in profits in the September quarter, the outlook remains strong

Ram Prasad Sahu Mumbai After falling 4.4 per cent on Monday due to lower than expected net profit in the September quarter, the Motherson Sumi stock recovered on Tuesday. The prospects appear on track, with the orders it got in the first half of the financial year and scope for margin improvement as new facilities come on stream.

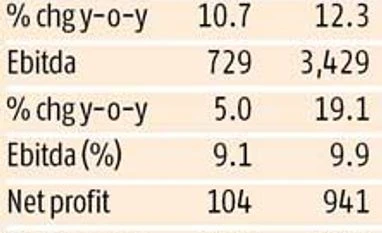

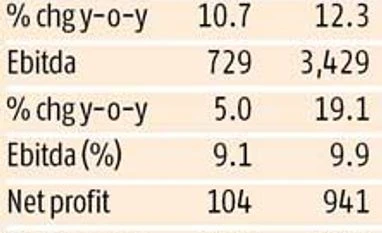

The company reported a 25.7 per cent fall over a year earlier in net profit to Rs 104 crore. This was on one-off reasons such as costs related to acquisition, foreign exchange losses and bond issue-related expenses. Adjusted for these, net profit fell three per cent to Rs 250 crore, on the back of higher interest costs as overall debt rose. This is in line with the consensus estimate of Rs 240 crore.

Consolidated net debt increased by Rs 1,193 crore since March to Rs 5,127 crore on increased working capital requirements, acquisition of minority interest in SMP and SMR, and the funds raised for acquiring US-based wiring harness maker Stoneridge. The company continues to look at inorganic opportunities and announced the acquisition of Minda Schenk in Germany. And, indicated two more acquisitions were in the pipeline and are expected to be completed in the current financial year.

The outlook is expected to be strong, given a robust order book, with additional orders of €1.3 billion or Rs 10,000 crore in the first half of FY15. The management, according to analysts, says 14 new plants across regions will start production, translating to higher revenues. Edelweiss Securities' analysts say recovery in the domestic market and the ramp-up at the new plants will drive a 50 per cent annual earnings growth over FY14-16.

Standalone operations (India and exports) saw revenue growth of nearly 13 per cent to Rs 1,247 crore. Operating profit margins declined a steep 270 basis points (bps) over a year to 18 per cent, due to an increase in staff costs and other expenses. The top line growth for the quarter has been slower than earlier but the management indicated the company continues to increase its content per car, move up the value chain and grow its market share. The company has indicated that India operations will account for 20-25 per cent of overall revenue over the next five years. For the quarter, the number was 16.6 per cent.

Its European subsidiaries, SMR and SMP, which together account for about 80 per cent of revenue, registered revenue growth of 14 per cent and seven per cent, respectively, in euro terms. Holidays in Europe and a slowing in the European market dented SMP's performance. SMR managed to improve its margin in operating earnings by 30 bps to 9.1 per cent, on the back of higher utilisation at new plants. Lower top line growth reflected in the flattish margin for SMP at six per cent. Analysts expect this to go up to nine per cent, with top line growth doubling to 14 per cent from the September quarter number.

While the company achieved a return on capital employed (ROCE) of 25 per cent for the consolidated entity for the half-year ended September, the management has reiterated its goal of achieving a 40 per cent ROCE by March 2015. The standalone entity (primarily India operations) has a ROCE of 35 per cent.

)

)