US demand revival brings new hope to Indian acquaculture firms

With the US raising the duty on shrimp and other aquaculture products from China to 25% in the latest round of tariff levies, experts believe US orders would now shift to India

)

Explore Business Standard

With the US raising the duty on shrimp and other aquaculture products from China to 25% in the latest round of tariff levies, experts believe US orders would now shift to India

)

After slowing down for a while, Indian aquaculture companies are stepping ahead for a turnaround due to a revival in demand from America, the world's largest consumer.

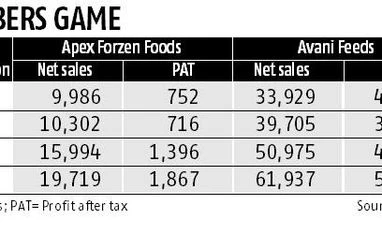

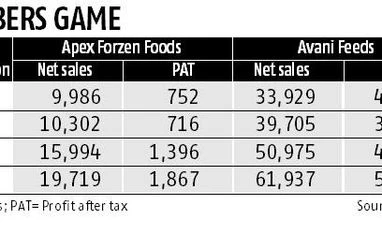

Most companies saw a sharp decline in revenue and profit till the December 2017 quarter, spilling over in some cases to the March 2018 one, too. However, leading companies in the segment posted an increase in sales and profit during the June 2018 quarter. This was thanks to a high import duty levied by the US government on its largest supplier, China, in an ongoing trade war.

Starting with 15 per cent early this year, the US administration raised the duty on shrimp and other aquaculture products from China to 25 per cent in the latest round of tariff levies, totalling $200 billion. Experts believe US orders would now shift to India.

"All players in the industry believe the worst is behind, US demand has recovered and would accelerate as the festive season begins. Both international shrimp prices and Indian farmgate prices have recovered sharply in the past few weeks. India has already garnered a sizable share (35 per cent) of US shrimp import; it would gain more, due to its efficient aquaculture practices. Also, Indian processors are trying to move away from commodity products and eyeing a larger share of the value-added market," said Depesh Kashyap, an analyst with Equirus Securities.

Farmgate prices of Indian shrimp have jumped nearly 10 per cent to Rs 380-400 a kg (40-count ones). Avanti Feeds, a leading entity in the segment, had net sales of Rs 8.343 billion for the March quarter and Rs 10.402 billion for the June one. Apex Frozen Foods and The Waterbase had similar rises.

"Conditions on the ground have started improving with recovery in farmgate prices," said Suresh Kumar, chief financial officer at The Waterbase.

Indra Kumar, chairman of Avanti Feeds, told analysts that farmers used the slowdown as an opportunity to rejuvenate their ponds. Avanti has 45 per cent of the market in feed.

The industry does face a rise in input prices. The central government's decision to raise the minimum support price for soybean would, for instance, push soymeal prices.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Sep 25 2018 | 10:51 PM IST