Ola raises $400 mn from DST Global, GIC, others

Earmarks $100 million for TaxiForSure; aims at a presence in 200 cities by December

BS Reporter Bengaluru Mobile application-based taxi and auto-rickshaw aggregator Ola (earlier OlaCabs) on Thursday said it had raised $400 million in series-E funding. The fund-raising round, led by Russian venture capitalist Yuri Milner’s DST Global, valued the city-based company at $2.5 billion, possibly the most among Ola’s Indian peers, sources said.

Other investors in this round included Singapore’s sovereign wealth fund GIC and Falcon Edge Capital, apart from existing investors SoftBank Group, Tiger Global, Steadview Capital and Accel Partners US.

While sources say Milner holds a personal stake in Ola, this is DST’s second investment in India. In 2014, it had acquired significant stake in e-commerce company Flipkart.

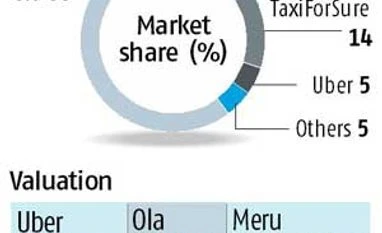

The fund-raising comes within six months of Ola raising $210 million from Japan’s SoftBank and close on the heels of the company acquiring TaxiForSure for Rs 1,240 crore ($200 million) in a cash-and-stock deal, which made the combined entity the largest technology-backed cab aggregator in India.

“Ola offers a strong value proposition for both users and drivers and is transforming personal transportation in India,” said Rahul Mehta, managing partner, DST Global. “We’re excited by its impressive growth and the potential to expand the platform into other categories. We look forward to continuing working with its visionary founders and management.”

Ola said it had earmarked $100 million from this round of funding for expansion and growth of TaxiForSure. The funds will also be used to expand Ola’s footprint from 100 to 200 cities by December this year.

“The additional investment will allow Ola to go deeper into smaller cities and build personal transportation ground-up,” the company said in a statement. “Ola has already seen tremendous growth in tier-II and III cities, owing to the limited transportation options in these regions currently. The company aims to further localise its offerings for citizens and driver partners in every market.”

Recently, Ola added an instant food-delivery feature, OlaCafe, currently available across four cities. The company has said it will continue to invest in cutting-edge technology for both customers and drivers.

Even as the app-based taxi and auto-rickshaw aggregator segment has seen several regulatory hurdles in India, companies in this sector have been steadily growing, launching new services through the past few months.

Ola’s competitor Uber, which had come under the regulatory scanner after one of its drivers allegedly raped a female passenger in the national capital, recently launched an auto-rickshaw aggregation feature on its app, reflecting its bullish outlook for India.

“With the game-changing Uber, the taxi market in the West has been taken by storm. In India, the market has been significant but very fragmented,” said Harish H V, partner at Grant Thornton. “Ola? is one of the players working actively on consolidation; it has effectively used mobile apps in India. Now, it is a question of scaling up and garnering a large share of the market, which is now seeing three or for players. Clearly, investors are bullish about the business and are, therefore, supporting the company.”

)

)