Gains sprout for cement amid rains

Experts say upward trend in stocks an aberration

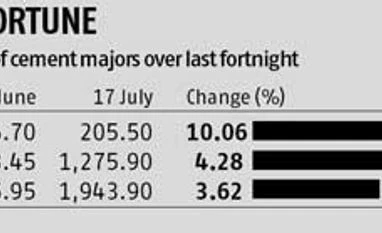

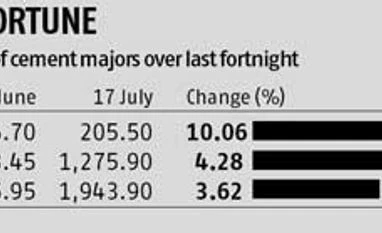

Chandan Kishore Kant Mumbai Shares of India’s top-three cement makers, UltraTech, ACC and Ambuja, have shown a surprising upward movement of four-10 per cent over the last fortnight. This has come at a time when the sector continues to face over-supply of capacity, weak cement prices and poor demand.

Also, monsoon is at its peak. Usually, during rains, cement stocks tend to trade low as construction takes a back seat.

These companies are coming out with their June quarter results this month and have indicated for dividends (interim and final) and provided book-closure dates. Experts said dividends were a reason why shares of the largest cement makers had outperformed their peers and the benchmark indices.

The three control a third of India’s cement market, current capacity, 350 million tonnes per annum.

Ambuja Cements, part of the Swiss cement giant Holcim’s Indian operations, has gained 10 per cent this month and closed at Rs 205.50 on the Bombay Stock Exchange (BSE). Last when the counter closed over Rs 200 was in January. Shares of sister concern ACC are up 4.3 per cent during the period. Holcim’s rival, Aditya Birla Group’s UltraTech Cement, gained over 3.6 per cent.

Teena Virmani, vice-president, Kotak Securities, who tracks cement sector, said, “The sharp upward move could be in anticipation of demand and price revival after monsoon.”

Experts, however, questioned the sustainability of the rally as two months of rains are yet to go. This could be an aberration, they said.

"Cement companies have strong balance sheets and are not rate sensitive," said Jinesh Gandhi, analyst at Motilal Oswal Financial Services.

Buzz of merger of Holcim's ACC and Ambuja is there again. However, Holcim has been denying any such possibility ever since it took over the those. Sources said the two would be eventually merged, but it does not seem likely.

Global research firm Credit Suisse, in its recent report, said, "We think a merger of the two would address capacity constraints and synergies could be 10 per cent of the combined profit. We stay positive on Ambuja and ACC.""

)

)