Rising demand allows steep rise in steel prices

The approaching festive season and restocking are the reasons

)

Explore Business Standard

The approaching festive season and restocking are the reasons

)

Flat steel producers have raised prices (effective August 1) up to Rs 3,000 a tonne, one of the steepest in recent times.

Last month prices were raised by about Rs 1,500 a tonne. With improving demand, these have moved ahead of raw material prices, signalling the industry's stronger grip over the market. In the past 30 days, the latter have increased by about $100 a tonne; China has raised by 4.4 per cent this year, as opposed to 0.1 per cent last year.

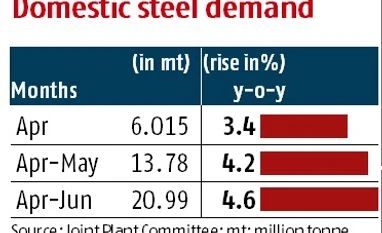

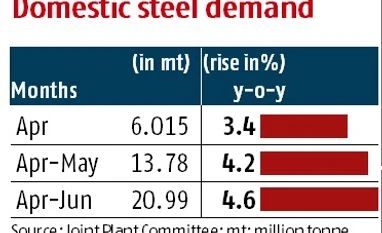

A steel producer said there was also a strong demand revival in the domestic market, partly due to the approaching festive season and due to restocking after clearing of uncertainties in the post-goods and services tax scenario.

Producers do not rule out another increase towards the middle of the month. "We see domestic demand for steel continuing to rise, as government spending has moved up in areas such as solar energy, water and transmission pipes. Due to this, domestic prices have the scope to move up by seven-eight per cent," said Jayant Acharya, director (commercial) at JSW Steel.

However, it remains to be seen if the demand-pull at home is sustainable. "With the landed cost of imported hot rolled coil reaching almost $510 a tonne, the (present) anti-dumping duty or safeguard duty will not be applicable. The only protection for the domestic industry at this level is the basic customs duty. Raising domestic prices beyond this level will have to be supported by either a further increase in international prices and/or a significant improvement in local demand," says Jayanta Roy, senior vice-president at ratings agency Icra.

Earlier, to protect the domestic industry from an onslaught of cheaper import, the government had imposed anti-dumping duties of $478 to $489 a tonne on hot rolled alloy and non-alloy coils (HRC) and $561 a tonne on hot rolled steel plates from China, Japan, Russia, Indonesia, Brazil and South Korea.

Domestic HRC before this round of price increase was Rs 36,800 a tonne.

On the cost side, iron ore prices which had tapered to $50 a tonne are now around $75. Coking coal has moved from $145 a tonne to about $180. These two together account for about 75 per cent of steel's input cost.

FACTORS LEADING TO THE HIKE

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Aug 08 2017 | 1:32 AM IST