Indian steel companies are resorting to asset sales, refinancing of local loans with dollar loans, and recasting loans under the Reserve Bank of India’s 5/25 scheme to control their spiralling debt.

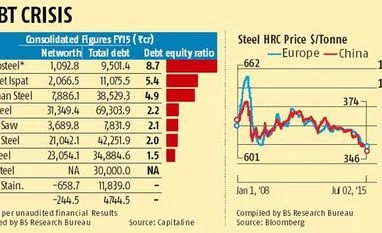

In its financial stability report last week, the RBI had warned steel companies would not be able to service their debt as the infrastructure sector grappled with stalled and delayed projects. The banks are worried about their over Rs 3 lakh crore exposure to the steel sector, with the top 10 companies making up for the majority of the loans (see chart).

Five of the top 10 private steel companies were under severe stress, the RBI said. The companies say they are taking steps to reduce their debt and intend to sell more assets in 2015-16. “The steel companies are going through their worst patch. Unless they sell assets, it will not be possible for many of them to repay loans,” said the chief financial officer of a large steel company asking not to be named. “All companies are in the same boat, and they have been told to either sell assets or bring more cash to the table,” he added.

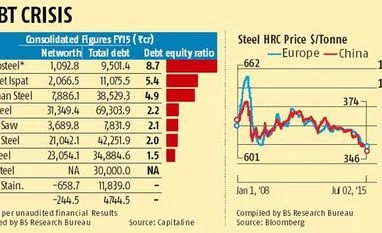

India’s most indebted steel company Tata Steel has announced plans to sell its long products division in Europe, but it has not been able to close the deal because steel prices fell internationally reducing the valuation of the unit. This week, Tata Steel began talks with lenders to reduce its interest cost by 0.9 percentage points on a $1.5 billion loan taken last year. Tata Steel had signed $1.5 billion term loans as part of a $3.1 billion refinancing last year, bankers said.

The sector’s woes are low demand and falling prices. According to Emkay Equity Research, CIS Export hot rolled coil prices continue to hover around $365 a tonne because China is exporting steel at a cheaper price and keeping global prices low. In India too, a 2.5 per cent hike in the import duty did not have any impact on domestic prices because of poor demand. Domestic steel prices fell by about 5-6 per cent during the past three months, Emkay Equity said.

To help Indian companies to tide over the debt crisis, the RBI came out with a 5/25 scheme that extends the tenure of loans to 25 years with an option to refinance in five years. Bhushan Steel and Essar Steel have opted for it. According to Essar Steel executives, the company reduced its finance cost by 7.4 per cent to Rs 3,865 crore in 2014-15 from Rs 4,176 crore in 2013-14 and made a profit after tax of Rs 648 crore against a loss of Rs 1,597.14 crore in the prior year. The company also reduced its debt to Rs 30,000 crore by selling assets.

“We want to strengthen the balance sheet through infusion of funds, ramping up production, and improving profitability,” Firdose Vandrevala, executive vice-chairman, Essar Steel India, said on May 27. Essar Steel converted its local loans worth $2.2 billion to dollar loans, thus lowering its interest cost. The Ruias also infused around Rs 1,300 crore equity and sold the Odisha slurry pipeline and oxygen plant for around Rs 4,850 crore. The company was planning to sell the Visakhapatnam slurry pipeline and coke oven for Rs 7,000 crore in 2015-16, executives said.

The lenders to Bhushan Steel have approved a debt restructuring plan under the 5/25 scheme. The company with a massive debt of Rs 38,529 crore plans to ramp up capacity utilisation to 90 per cent from the current 65 per cent to increase its topline so that it can repay its loans.

One of India’s better managed steel firms, JSW Steel, with Rs 34,889 crore of loans on its books, does not foresee any problem with its spiraling debt. Chairman Sajjan Jindal said the company’s margins were strong to service its debt. “If you see the debt-to-equity and debt-to-Ebitda levels in the sector, we are relatively the best,” said Jindal in an interview to this newspaper.

)

)