Sun Pharma: No sunshine in FY16

Muted guidance by the management has led to earnings downgrades and could lead to potential de-rating of the stock

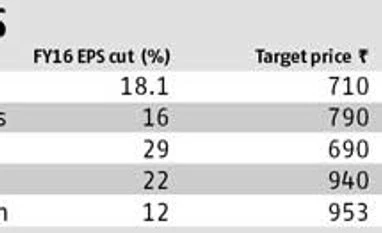

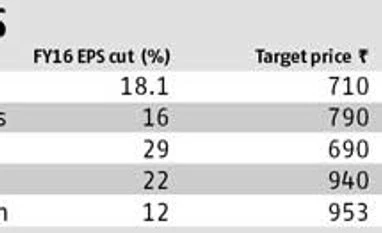

Ram Prasad Sahu Mumbai Steep downward revisions in earnings by brokerages following the profit warning for FY16 by the Sun Pharma management saw the stock lose 15 per cent in trade on Tuesday to Rs 805 levels. Brokerages have cut the company’s FY16 earnings estimates between 12 per cent and 29 per cent with target prices, too, coming down to the Rs 700-800 band.

Tuesday's decline has seen an erosion of over Rs 34,000 crore in Sun's market capitalisation, which is far higher than its $4 billion deal to acquire Ranbaxy in April last year. One possible reason for the sharp decline is that the market was not expecting the warning.

The company had not disclosed the FY16 guidance during the March'15 quarter results as it needed more time to ascertain the full impact of the integration costs. Interestingly, the March quarter results also disappointed the street due to unexpectedly high integration costs relating to the Ranbaxy merger. Among other reasons for the fall could be the recent rally of nearly 12 per cent in the stock, as well as the premium valuations that Sun enjoyed due to its consistent track-record. However, even after the decline, the stock could remain under pressure (or range-bound) in the backdrop of weak outlook.

The guidance of flat to lower consolidated revenues year-on-year for FY16 is on account of supply constraints at Halol plant, pricing pressures in the US market, and the company’s decision to part with business segments, products, and geographies that are low-margin and offer no long-term strategic benefits such as the tender business. What has caught investors by surprise is that the Halol plant contributes 20-25 per cent of total sales and the revenue guidance means other businesses, too, are likely to underperform. The guidance also includes benefits from the launch of Gleevec (blood cancer drug) in the US market early next year. The company has, however, indicated it will grow at a sustained pace starting FY17.

The pressure on the firm’s profits is on account of higher research and development (R&D) costs, remediation measures and integration costs. Higher R&D expenses are due to MK-3222 trials and increase in the marketing efforts for ophthalmic and over-the-counter segments in the US. MK-3222, which is licensed from Merck, is in phase-III clinical trials and is used for treatment of chronic plaque psoriasis, a skin ailment.

The management indicated the integration costs would be a one-off and not recurring in nature. The company, however, is confident of the contribution of Ranbaxy business to its goal of outperforming industry growth rates from the next financial year. While the near-term is likely to be difficult, the company has reiterated its faith in the acquisition and increased the target of $250 million synergies in the next three years after integration by 15-20 per cent. The key benefits are likely to come from sourcing of products at lower costs and through sales synergies. The Sun management said the remedial action at Ranbaxy’s plants in Mohali, Dewas, Poanta Sahib and Taonsa facilities is on track and the company would like to expedite the resolution of at least one which is most likely Mohali, the newest of the four facilities.

But, given the near-term pressure on sales and profits, expect the stock to remain range-bound going ahead.

)

)