A day spent at the back-end facilities of the Future Group, inside Nagpur's Mihan complex, is like a lesson in de-mystifying end-to-end supply chain management, without which the glitzy malls and stores might collapse.

At the heart of the end-to-end supply chain are three steps - store, move and deliver - at every leg, one is told. That one cycle could take anything from 300 to 700 days for, say, an apparel, from the time of plucking cotton to buying the dress. More scientifically, the supply chain would mean warehousing, transportation, storage, inventory holding, packaging and even wastage, all adding to a $200-bn industry in India, of which roughly $20 bn could be the retail logistics/back-end pie.

Kishore Biyani's Future Group is the only retail chain to have a back-end operation in the sprawling Multi-modal International Cargo Hub and Airport at Nagpur (Mihan), a 4,300-hectare complex meant for industry logistics, apart from airport and township. Future, in a joint venture with Hong Kong's Li & Fung, handles around 500,000 pieces a day - everything non-food, from apparel to electronic devices, furniture, toys, luggage and accessories, from a facility spread over 367,000 sq ft. Maharashtra Airport Development Company, which plays a lead role in developing Mihan, has invested Rs 110 crore in constructing the building, and Future Supply Chain Solutions (FSC) has taken it on lease for 26 years. The Mihan hub is the supply chain backbone for around 1,000 stores across the country, and this warehouse is expected to cater to a throughput of $1-bn sales in 2013.

The group has decided to take a second building in the same complex, which could be used as a transport hub or for frozen food. The annual supply chain/logistics spend of the Future group is pegged at around Rs 250 crore.

When Anshuman Singh, the man who drives the back-end at Future Retail, got into the groove of supply chain management in the mid-90s in another organisation, it was a strange three-letter word. Much has changed since, as he has switched jobs from back-end to front-end retail to back-end again. As the managing director and chief executive officer, FSC, he is much in demand across B-school campuses on unraveling the mysteries of what goes on before products hit the store shelves.

As he shows around the paperless and Wi-Fi facility in Mihan, where the man-machine combination is helping not just Future but many other retailers which are FSC clients, Singh talks about his previous stint with the group. That was about 10 years ago with Pantaloon, now owned by Aditya Birla. His challenge then was to model the chain on global fashion brand Zara, known for a very short lead time from research to order to manufacture to delivery. At Pantaloon, the lead time shrunk to three months and in some cases to 21 days from much more earlier, to keep the fashion fresh. "So, when Pantaloon Family Store became Pantaloon Fresh Fashion, it was actually a supply chain change, and not a marketing change," points out Singh.

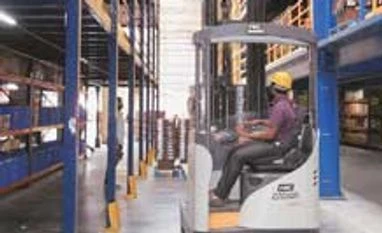

By this time, company executives are busy explaining jargon like 'warehouse management system', 'put to light sortation', 'print and apply', 'put away', 'auto replenishment' and 'same day despatch', as hand-held scanners, priced at Rs 60,000 each, are busy sorting the items, from clothes to toys to TV sets, for the workers to put into the right boxes, without having to think or calculate. Then there are mechanised trolleys and dock levellers, some costlier than a Mercedes, that pick products and boxes from shelves several storeys high and loading these on trucks. "There's no chance of any inaccurate dispatch. Also, products go to the stores just the way they can be displayed on the shelf," says Sanjeev Kumar Mandal, general manager of FSC at Mihan. Nobody knows which store a carton is headed to, as barcodes denote the products and destinations. "Thinking is not allowed in such a high throughput place," says another exec, adding that eight applications work seamlessly to keep the supply chain going.

Products being transported can be tracked second by second. The entire transportation is by road here through seven road corridors across the country, and transit time doesn't exceed 48 hours to any place from Nagpur.

Logistics company FSC was born when Singh came back to the Future Group with aspirations of being an entrepreneur. He even bought a four per cent stake with the money he was saving to buy a house. His stake got diluted once Li & Fung bought 26 per cent in the venture in 2009.

While 100 per cent of Future back-end is handled by FSC, around 50 per cent of the latter's business comes from other chains. A recent global ranking put Singapore on top, followed by China in terms of supply chain and logistics capabilities. While the US was rated ninth in the list, India was down at 46th.

FSC has around 4,000 people, including on-rolls and contract, and the number is down from 5,000 in 2007 even as the size of the operation has doubled. Singh attributes this to increasing use of technology in the man-machine model.

When it realised recently that transportation was a black hole, it launched a transport management system. Around 90 per cent of FSC's transport business caters to a market outside of Future. Among its clients for warehousing, transportation and distribution are Tata Motors, ITC, Hitachi, Cadbury's and Ford Motors.

)

)