Considering the popularity of the brand, Titan hopes that these new set of fragrances will catch on with the young consumers across the country.

Fastrack was launched in 1998 and retails across the nation through 173 exclusive stores in over 79 cities as well as authorised multi-brand outlets. It also has online presence.

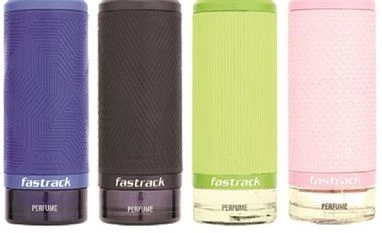

Fastrack watches sees an annual growth of around 9 per cent and contributes nearly 35 per cent to Titan’s overall revenue. The new range of fragrances will be sold under Fastrack Perfumes and come in seven different variants. These perfumes will be priced below Titan’s mid-level line Skinn Perfumes.

Skinn sells around 1.5 million bottles a year, which adds around Rs 120 crore to Titan’s revenue. It is seeing double-digit growth. “Fastrack perfumes are expected to be around a third of Titan’s fragrances volume in the near future. Fastrack is likely to overtake Skinn’s volumes in a couple of years due to the large youth potential,” said Titan’s chief operating officer for the accessories division Manish Gupta.

Fastrack Perfumes, which signed actor Ananya Panday to endorse the brand, will cater to younger demographics aged between 16 and 21 years.

The suite of products range between Rs 835 and Rs 995. They cater to both men and women, are formulated by international perfume houses Givaudan and Firmenich and made through tie-ups with contract manufacturers in Vapi, Gujarat. “Currently, consumption in the fragrances category is driven by the top 10 cities in India that are the usual metropolitan cities but we expect the next wave of growth to come from the next 10 emerging markets,” Gupta said.

Market analysts say Chandigarh and Guwahati are other cities seeing high sales and increased traction for the fragrance business. Broadly, the sector is divided into categories by the name ‘mass’ and includes players such as Fogg, ‘masstige’ that includes Skinn, ‘prestige’, which includes brands such as Guess and David Beckham, and ‘premium’, which includes Giorgio Armani, Christian Dior and Chanel, among others.

According to a report by Research and Markets, the Indian perfumes and deodorants market was valued at $790 million in 2017. It is projected to grow at a compound annual growth rate (CAGR) of over 17 per cent, to $2.4 billion by 2024.

This will be due to the fast-rising urban population, coupled with growth of online retail. “The Indian fragrances market has its own nuanced evolution in that it’s broken up into two categories – deodorants or ‘body sprays” and perfumes,” said Rajesh Mishra, founder of market research firm Thinking Hats. Currently, deodorants dominate the market while perfumes in a variety of formats are growing fast.

Saurav Bhattacharya, president of operations at Dubai-based specialty perfumery Ajmal & Sons, said that today look good, feel good, and smell good are what all young people aim for in terms of image. “However, if you don’t smell good it doesn’t matter if you look good,” he added. “The trick in this business is to make a relevant product at a price point that is between Rs 500 and Rs 1,000, serves as a bridge and allows for upward movement into the perfume world,” Bhattacharya said.

Varsha Dalal, founder of Divine Cosmetics, which launched a ‘masstige’ fragrance line under the brand name Embark (priced around Rs 1,600 for a 100 ml bottle), said the big challenge is discounting, which puts pressure on manufacturers that operate on the lower end of the pricing scale. Tony Chin, CEO of Beauty Concepts, which retails dozens of premium fragrances such as Bulgari in India, said while the overall business is growing, it’s the class and the mass products that result in easy sales.

“The in-between categories see more crowding and therefore more jostling for space,” he said. So, will Titan ever go beyond the mass and masstige price categories for fragrances and move up the value chain to premium and prestige? Gupta thinks it can’t be ruled out and could be the logical next step.

One subscription. Two world-class reads.

Already subscribed? Log in

Subscribe to read the full story →

Smart Quarterly

₹900

3 Months

₹300/Month

Smart Essential

₹2,700

1 Year

₹225/Month

Super Saver

₹3,900

2 Years

₹162/Month

Renews automatically, cancel anytime

Here’s what’s included in our digital subscription plans

Exclusive premium stories online

Over 30 premium stories daily, handpicked by our editors

Complimentary Access to The New York Times

News, Games, Cooking, Audio, Wirecutter & The Athletic

Business Standard Epaper

Digital replica of our daily newspaper — with options to read, save, and share

Curated Newsletters

Insights on markets, finance, politics, tech, and more delivered to your inbox

Market Analysis & Investment Insights

In-depth market analysis & insights with access to The Smart Investor

Archives

Repository of articles and publications dating back to 1997

Ad-free Reading

Uninterrupted reading experience with no advertisements

Seamless Access Across All Devices

Access Business Standard across devices — mobile, tablet, or PC, via web or app

)