The top six companies in the steel sector led the growth of crude output in the first nine months of 2016-17.

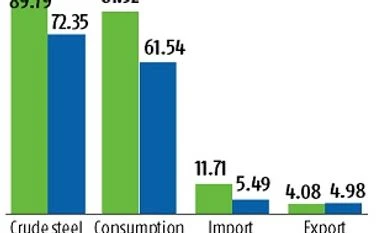

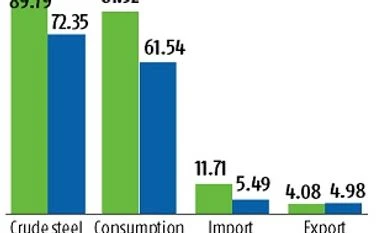

During April-December 2016-17, the production of crude steel stood at 72.34 million tonnes (mt), a growth of 8.8 mt compared to the same period the previous year. Steel Authority of India (SAIL), Rashtriya Ispat Nigam (RINL), Tata Steel, Essar Steel, JSW Steel and JSPL produced 40.37 mt during this period, a growth of 15.7 per cent over the previous year.

The balance 31.97 mt was contributed by others, which was a growth of 1.1 per cent.

While the top six say their capacity utilisation was 80-90 per cent, that at the smaller entities is quite different. “Capacity utilisation among secondary producers is less than 65 per cent,” said one.

“The big primary producers mostly have captive mines. We have to buy iron ore from the market. Also, there is an issue with railway rakes. The bigger players get rakes,” he added.

There are other issues, too. “Typically, smaller players would have a substantial proportion of long steel products in their portfolio. The bigger players have been able to overcome muted demand in the domestic market by increasing exports significantly. This would not hold for the smaller ones, as international trade is primarily in flat steel,” says Jayanta Roy, senior vice-president at rating agency ICRA.

Sanak Mishra, secretary general, Indian Steel Association, says this rise in export and the government’s protective measures against cheaper imports were major helpful factors to keep capacity utilisation up.

Though the big companies mentioned earlier account for more than half the production of Indian steel, small producers (who use sponge iron, melting of scrap and non-coking coal for steel making) are a sizable lot.

According to the draft National Steel Policy, as on March 2016, there were 308 sponge iron producers that used iron ore pellets and non-coking coal or gas as feedstock to make steel; 1,175 electric arc furnaces and induction furnaces that use sponge iron and or melting of scrap to produce semi-finished steel; and 1,392 re-rollers that put semi-finished steel into finished production for consumer use.

)

)