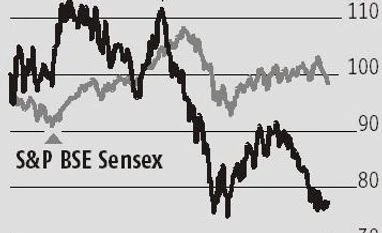

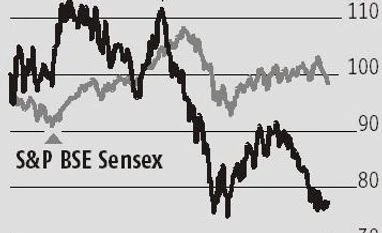

The Apollo Tyres stock is down 14 per cent since the start of the month on worries of rising competitive pressures, slowing demand from automakers and lower-than-expected December quarter numbers.

Revenues in the quarter did not grow as anticipated due to volume growth, which failed to meet expectations both in domestic as well as international businesses. Margins, which were impacted by higher raw material costs, were down by 100 basis points to 11.2 per cent.

The key worry is weak demand from original equipment manufacturers (OEMs) or automakers, which account for 30 per cent of its sales. Given the slowing sales in the auto sector, the company rolled back price increases it had taken at the end of November 2018.

Analysts at CGSCIMB believe that high competitive intensity in truck radial tyres has led to price cuts.

They add that headwinds for its India operations will be pronounced in coming quarters given easing demand for automakers, slowing truck freight and aggressive pricing competition. Inventory levels, too, have increased by a week to five weeks given the sluggish order flows.

While there are demand headwinds, the company will, however, benefit from falling raw material costs that had weighed on their December quarter financials. While most auto ancillary companies are facing the brunt of slowing auto sales, which is reflected in their stock prices, analysts believe that tyre companies are better off given that a substantial chunk of sales (60 per cent) comes from the replacement segment, which has steady demand, unlike the OEM segment.

Further, pricing power in this segment is better as compared to the OEM segment. Its European operations also posted strong revenue growth and the company gained market share in a seasonally strong quarter.

The company has maintained its double-digit growth guidance for the March quarter, as well for FY20.

While falling raw material costs are positive, given demand headwinds, investors should avoid exposure at current levels. Analysts have cut its earnings per share estimates for FY20 by 7 per cent in the view of higher capex and interest expense.

)

)