Wockhardt promoters recast shareholding

MD Murtaza Khorakiwala gets big share of family wealth

Dev Chatterjee Mumbai As part of pharmaceutical company Wockhardt's succession plan, 71-year-old founder Habil Khorakiwala is gearing up to make way for the next generation. The Khorakiwala family has made significant restructuring of its shareholding in the company, with son Murtaza getting a significant share of the family wealth.

Murtaza Khorakiwala, 41, is also managing director of the company and runs its day-to-day operations. The drug firm, which had gone through financial turmoil in 2009-10 after its derivative bets went wrong, had to seek a debt restructuring from banks earlier.

The Khorakiwala family owns a 74 per cent stake in Wockhardt, worth Rs 4,800 crore by Friday's BSE closing stock price of Rs 586 a share. The company's shares have been transferred to partnership companies controlled by Murtaza and his father by way of a gift deed, according to disclosures made to the stock exchanges.

In a rare gesture, Habil's other son, Huzaifa, is reported to be against taking any share in the family wealth and is planning to concentrate on corporate social responsibility. Khorakiwala's daughter, Zahabiya, will continue to manage the unlisted hospital business.

When contacted, a spokesperson for Wockhardt said the company would not comment on the issue as it was "an internal family affair".

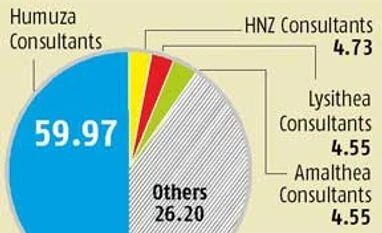

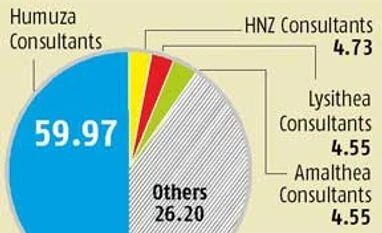

According to stock exchange statistics, family firms Humuza Consultants, HNZ Consultants, Lysithea Consultants and Amalthea Consultants acquired the shares from the family's promoter companies between June 30 and July 8. "The older generation wants to hand over the reins in a peaceful manner, instead of (leaving room for) conflicts at a later date," said an insider. Corporate India has seen many examples of sibling rivalry, where brothers have turned against each other and ended by destroying shareholder wealth.

Both Murtaza and Huzaifa had joined the Wockhardt board in 2009. While Murtaza took over as managing director, Huzaifa was an executive director of the company and chief executive of Wockhardt Foundation. Murtaza graduated in medicine from GS Medical College, Mumbai, and holds a master of business administration (MBA) degree from the University of Illinois, USA; Huzaifa is a commerce graduate from Mumbai University and holds an MBA from Yale University's School of Management. Huzaifa had joined the company in July 1996 and was more interested in working for the poor since the beginning, even as the company was steered profitably by Habil and his team.

However, things changed drastically for the company as it suffered huge losses following wrong derivative bets worth Rs 555 crore and defaulted to its bond holders in 2009. The company was later sued in the Bombay High Court by bond holders, who sought return of their funds. The bond holders received part of their payment as settlement. Soon after, the company again found itself at a receiving end, with the American drug regulator finding lax quality standards at one of its plants. The company had to sell its nutrition business to Danone in 2011 for $311 million, besides part of its hospital chain, to raise funds to repay its lenders.

Wockhardt took several steps, including a new team to improve its financial health and quality standards at its plants. After this, Wockhardt made a profit of Rs 198 crore on a revenue of Rs 1,805 crore in 2013-14. This was in sharp contrast to the losses the company had been making a few years ago.

)

)