As competition from homegrown and international brands grows stronger, Woodland, the Indian label with Canadian roots, is taking a hard look at its product line and marketing and sales strategy. An expanded apparel line plus an entry into specialised sports equipment and travel gear is being planned to bolster its credentials as an outdoor and adventure brand. At the same time Woods, its fashion and lifestyle chain of stores, is being promoted more aggressively as a premium extension of the core brand.

By tapping into the country’s rapidly growing adventure market and increasing its presence in the high-margin, urban lifestyle segment, Woodland hopes to match its new and nimble footed challengers: the Bengaluru-headquartered Wildcraft and global chain Decathlon. Both brands have tapped into the fitness fever that has gripped the urban young and the growing number of adventure tourism enthusiasts in India. Decathlon for instance, has invested in creating a store experience that appeals to such customers. Wildcraft, set up by a couple of adventure and sports enthusiasts, is pitching itself as the brand that experts turn to and has found immense appeal among young college goers.

Woodland is fighting back by paying more attention to its clothes line and getting into sports and travel gear. Apparel currently contributes 40 per cent of its annual turnover and apart from coming up with an improved set of products within the existing line, the company is also foraying into inner wear where it expects to take on a bunch of unorganised players and established labels such as Jockey.

While the adventure and health-cum-fitness market is on a roll in India, experts say the brand’s big challenge will be to avoid diluting its promise while keeping its products affordable and functional.

Be it shoes, apparel or equipment, customers look for value and durability.

Woodland’s new product line is a reflection of the changing demand for such products says Managing Director Harkirat Singh. He is aware of the market realities he says. Expansions are necessary since “we have to change according to market needs and keep ourselves relevant for young customers,” he adds.

Woodland has been around for over two decades, landing up with Indian promoter Harkirat Singh when its Canadian owners found themselves in a financial bind. Singh’s company was a supplier to owners of the Woodlands brand and eventually bought it out and brought it to India sometime in early 2000. Right from the start, the brand found fans among the urban young. This is the segment the company is sticking with and wants to stay relevant for, hence the expanded line of clothes, equipment for water sports and mountain bikes.

The company is also planning a strong marketing push to build its appeal among its target audience. Singh says that brand loyalty is low among the young consumers and keeping this in mind, the company has decided to keep reinforcing the brand message. It currently spends nearly 7-8 per cent of the total turnover on advertising and promotions. While Woodland continues to focus on conventional advertisement avenues, it is slowly increasing its digital spend.

The new range will be sold through 600 company-run stores and about 4,000 multi-brand outlets. “Initially, the bikes will be imported from Taiwan. The company has piloted these bikes and equipment and found good response in the market,” says Singh.

Woodland has benefited from the growing consumer interest in the adventure, sports and fitness segment and in the last five years, it has nearly doubled its revenue from ~750 crore to ~1,350 crore today. The company grew about 15-20 per cent in 2016-17 compared to a year ago. According to Singh, the new products will help the company hit its business target of around ~2,000 crore in the 3-5 years. He is particularly optimistic about the inner-wear market, which is largely unorganised and estimated around ~15,000-20,000 crore.

According to a study on adventure tourism by Nielsen that was submitted to the Ministry of Tourism in October 2016, the size of the market is ~1,815 crore. Quality and price are the key elements in winning the market say experts.

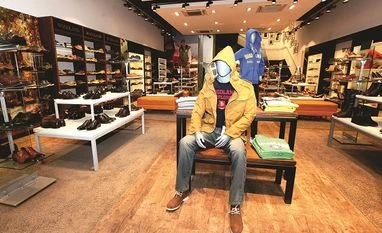

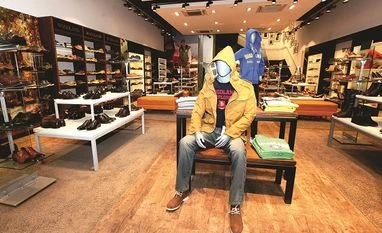

Woodland is also developing the Woods brand, defining it as a small-sized boutique store for fashion and lifestyle apparel. This is targeted at a premium urban customer within an older age group. Woods also has an online sales channel and around 4-5 stores of Woods are currently operational in the metros.

The company is also focusing on technology to create products that incorporate the rapidly changing demands of customers. It partners with several companies to ensure that it has access to the best product research outfits; it has allied with Boa for shoes, Sympatex for shoes and jackets, Ortholite for Footbed and shoes, Avex for sipper bottles, Tifosi for eyewear, Vipole for trekking poles and a few others.

)

)