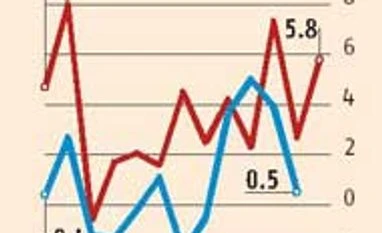

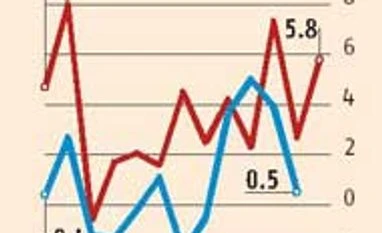

August core sector output rises to 5.8%

Steel, coal, cement & power generation provided the push

BS Reporter New Delhi Driven by good expansion in steel, coal, cement and electricity generation, the output of eight crucial core sector industries rose 5.8 per cent in August from 2.7 per cent in July, official data showed on Tuesday.

The eight industries had risen 4.7 per cent in August, 2013-14.

For the first five months of 2014-15, the eight grew 4.4 per cent, marginally higher than the 4.2 per cent in the corresponding period of the earlier year.

This might boost industrial growth data for August, which had dipped to 0.5 per cent in July. The eight industries constitute 38 per cent of the Index of Industrial Production (IIP).

Earlier, there was apprehension over IIP growth in August after a mere 2.35 per cent rise in merchandise export for the month. The August core sector data had allayed this fear about industrial growth in the month, said ICRA senior economist Aditi Nayar.

However, there is no one-to-one correspondence between core sector data and the IIP numbers. For instance, core sector output rose 7.3 per cent in June from 2.3 per cent in May but the IIP rise declined to 3.9 per cent from the earlier five per cent.

Crude oil, natural gas and refinery products saw production contracting in August. In July, five industries had seen a decline. Steel, which saw production falling 3.4 per cent in July, rose 9.1 per cent in August. Electricity generation rose 12.6 per cent in August after doing so by 11.2 per cent in July. In the first five months of the current financial year, electricity generation has grown by double digits in four months. The exception was May, when it expanded 6.3 per cent.

Production of coal, a vital raw material for electricity generation, increased 13.4 per cent in August, more than double the 6.2 per cent in July and the highest growth in it during the first five months of 2014-15. However, the recent Supreme Court decision on coal block allotments, cancelling all but four of the 218 made since 1990, makes it unclear if this can be sustained, said Nayar.

Cement posted 10.3 per cent growth in August, though lower than the 16.5 per cent in May. The fact that August also showed a monsoon revival showed that construction activity, either for infrastructure or for personal dwellings, is on the upswing.

The economy rose at a two-year high of 5.7 per cent in the first quarter of this financial year (April-June), after two years of below-five per cent growth. The Reserve Bank of India has retained its earlier economic growth target of 5.5 per cent for 2014-15, projecting growth in the second and third quarter to be moderating, before rebounding in the fourth one.

)

)