Backlog at old price will mean 7-year itch for RIL

Moily rules out review of pricing formula decision

Jyoti MukulShine Jacob New Delhi If the government decides to make Reliance Industries Ltd (RIL) fulfil its past gas supply obligation before allowing it to avail of a higher price of $8.4 per million British thermal unit (mBtu), the company will take a good seven years from April 2014 before it can become eligible for a price increase.

Besides, at its current level of production, RIL will be bound to the current price of $4.2 an mBtu which will make the government decision to adopt a new pricing formula irrelevant for the company.

Following adverse media reaction to the June 27 decision of the Cabinet Committee on Economic Affairs (CCEA), the finance ministry had issued an office memorandum asking the petroleum ministry to see if there was a way to make RIL clear its gas supply backlog at the existing price.

It also favoured a cap on the eventual price so that companies did not make windfall gains. The suggestions came a week after CCEA clearing the gas pricing formula suggested by the Rangarajan panel and Finance Minister P Chidambaram pushing for an early resolution of the issue.

Though Petroleum Minister M Veerappa Moily on Thursday denied a review of the government decision on pricing, as well as any capping of the increase, the finance ministry suggestions left analysts worried. “Estimates suggest, at the current production rate of 15 million standard cubic metres a day (mscmd), RIL will take seven years to meet the shortfall of 37,500 million standard cubic metres of gas.

This implies there might not be a price revision for gas from RIL’s KG-D6 field from April 2014 onwards,” Religare said in a report released on Thursday. Though an RIL spokesperson did not deny the calculations, he did not comment on the likely implications for the company.

Asked about the content of the ministry’s letter, including the possibility of ensuring RIL delivered the shortfall at the old price, Moily said: “The price hike will be applicable uniformly and it will be difficult to estimate how much it will be. The finance ministry has just put some newspaper clippings to our notice.”

CCEA had on June 27 decided, starting April 2014, the price of domestic gas will be determined on a weighted average basis, depending on international hub price and imported LNG prices.

The finance ministry’s suggestions are not clear on whether the gas supply backlog will be calculated on the basis of gap in supply and allocation (63 mscmd) or it will also include the fallback gas allocation (which will take the supply commitment figure to 93 mscmd).

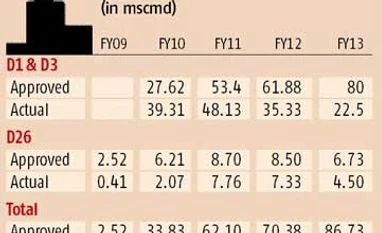

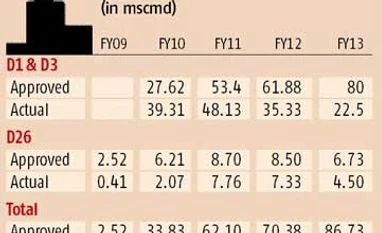

The other option is to take the difference between the actual gas supplied and the production quantity approved by the management committee since 2009, when the KG-D6 field started producing natural gas.

Religare sees any move to make RIL sell at the old rate beyond April 2014 meeting stiff resistance from the company and fears it might lead to arbitration.

)

)