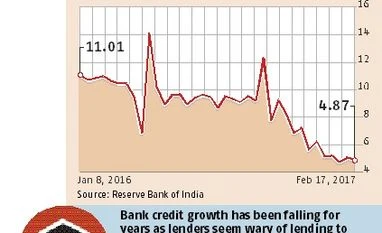

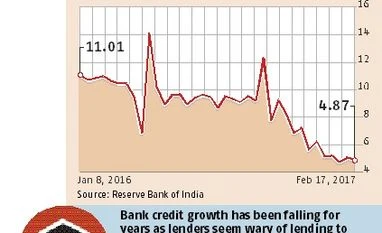

Credit growth in the banking sector continues to fall and has now registered a growth rate of 4.8 per cent as on February 17, data from the Reserve Bank of India (RBI) showed.

In the fortnight ended January 27, the credit growth had fallen to 4.71 per cent, lowest since at least 1998, the last data available with the RBI.

Credit growth was 11.2 per cent in the year-ago period. In the fortnight ended February 3, bank credit growth touched 5 per cent.

Bank credit growth has been falling for years as banks get wary of lending to companies for fear of a spike in bad loans. Such loans have already crossed Rs 6 lakh crore as on December 2016. Estimates suggest stressed assets, in various baskets of technicalities, were at least 12.5 per cent of the total loans, or about Rs 9.5 lakh crore of loans, in the system.

Likewise, manufacturing companies have witnessed about 30 per cent of their installed capacity remaining unused for several years. Therefore, loan demand in the system is mainly for working capital and not necessarily for project development.

In the weeks following demonetisation, banks remained busy handling the cash scarcity and lending activities came to a near halt, though recent government data showed economy grew at 7 per cent in the third quarter. The multi-year low slowdown in credit growth suggests banks did not lend in this period.

Non-food credit in the banking system, as on February 17, was at Rs 73.8 lakh crore, up only marginally from Rs 72.82 lakh crore in the fortnight ended October 28, the fortnight before demonetisation was announced.

Banks have enough reason to tighten their purse strings. In a recent research report, Credit Suisse said 37 per cent of loans were given in the past 12 quarters, or three years, to companies that had interest coverage (IC) ratio of less than one.

The ratio indicates companies are not fit to pay interest costs. In one-year period, these firms with IC of less than one, saw their earnings before tax and other deductions fall by 10 per cent.

This takes away the alibi of bankers that loans are not performing due to slowdown in the economy. The economic slowdown had started much before 2013 but banks continued to pour money on sick firms.

)

)