CAD seen at 4.4% of GDP

The Manila-based multi-lateral agency projected CAD to come down to 3.7% in 2014-15

BS Reporter New Delhi Like Prime Minister Manmohan Singh, the Asian Development Bank (ADB) today pegged India’s current account deficit (CAD) at five per cent of gross domestic product (GDP) in 2012-13 but projected it to be much lower, though still elevated, at 4.4 per cent in the current financial year.

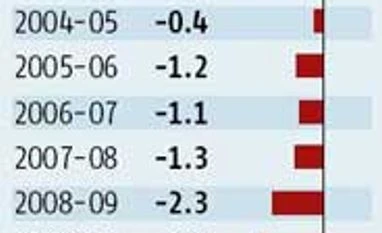

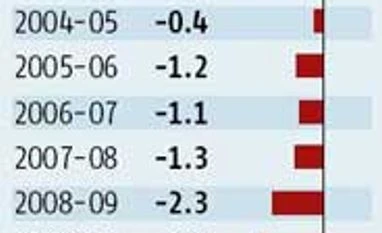

In its outlook for 2013, the Manila-based multilateral agency expects the CAD to come down to 3.7 per cent in 2014-15. If that be the case, the CAD would be above four per cent of GDP for three continuous years, beginning 2011-12.

ADB said financing the CAD would be a challenge for the government in the present environment of sluggish domestic growth and global uncertainty.

The CAD in April-December was 5.4 per cent of GDP, though it was 4.2 per cent of GDP in 2011-12. In the third quarter of 2012-13, the CAD breached all records to stand at 6.7 per cent. “The worsening of the CAD has been mainly on account of a deteriorating trade deficit, which has exceeded 10 per cent of GDP in recent years. Reforms are needed to facilitate the turnaround from growth deceleration due to structural bottlenecks, deteriorating investment and a worsening CAD.”

The report said policy disarray, supply-side problems and slow global growth had hindered the growth of exports. And, with inflation having made gold an attractive form of savings, imports had surged.

With the global economy growing at a slow place, exports are not likely to grow as these did in the 2003-07 period. Reverting to a sustainable level of CAD, which could be financed by stable capital flows, would demand the resolving of structural constraints that prevent investment and growth. Liberalising foreign direct investment would attract more stable capital, the report said.

)

)