Covid-19 second wave can hit energy demand in April-June quarter: Ind-Ra

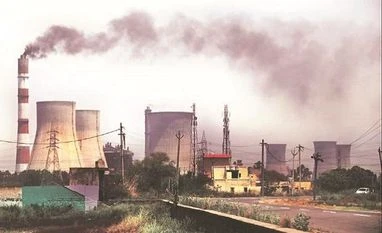

Restrictions following the second wave of the COVID-19 pandemic could impact energy demand growth recovery in the first quarter of this financial year, says India Ratings and Research (Ind-Ra)

Press Trust of India New Delhi Restrictions following the second wave of the COVID-19 pandemic could impact energy demand growth recovery in the first quarter of this financial year, India Ratings and Research (Ind-Ra) said.

The ratings agency has published the April 2021 edition of its credit news digest on India's power sector.

The report highlights the trends in the power sector, with a focus on capacity addition, generation, transmission, merchant power, deficit, regulatory changes and the recent rating actions by Ind-Ra.

Ind-Ra said the lockdowns on account of an increase in COVID-19 cases in various states could impact energy demand growth recovery in Q1 FY22 (April-June 2022), although all-India energy demand is expected to be higher on a year-on-year basis due to the low base effect as the country was under a stricter lockdown during the same period in 2020.

The short-term power price at Indian Energy Exchange continued its improving trend on a y-o-y basis (March 2021: Rs 4.07/unit; March 2020: Rs 2.46/kWh) with average monthly price in April 2021 at Rs 3.7/kWh.

The electricity generation increased 23.5 per cent on a yearly basis to 118.6 billion units in March 2021, supported by 29.2 per cent growth in thermal generation, although hydro generation fell 7.8 per cent.

Electricity generation from renewable sources increased 10.1 per cent to 11.9 billion units in March 2021, with solar generation increasing 21 per cent.

The improvement in energy demand and the reduced generation from hydro and renewables sources have helped the thermal plant load factor (PLF) increase to 66.5 per cent in March 2021 (March 2020: 51.5 per cent; February 2021: 63.3 per cent), it said.

In March 2021, the thermal sector's PLF (plant load factor or capacity utilisation) rose on a y-o-y basis across the central, state and private sectors, increasing to 80.4 per cent, 63.2 per cent and 57.9 per cent, respectively, it noted.

Despite the onset of summer season, the imposition of stricter lockdowns in major manufacturing states could impact demand from industrial segment which will impact thermal PLFs, it said.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

)