The World Economic Forum's (WEF's) annual meeting saw most of the discussions revolving around the rising importance of Asia and the role technology is playing for a young demographic.

Even though the International Monetary Fund (IMF) has reduced its global growth forecast to 3.5% for 2020, most corporate leaders were confident about consumer demand rising from Asia.

Alan Jope, chief executive officer of Unilever, saw Asia as the key engine for growth. “The Generation Z in India, Bangladesh is among the key consumers for us in the future.”

The consumption growth in the Asian markets will have to be managed differently. Several key trends will drive growth in Asia, which will be distinct from the past. “From mass production, mass consumption and mass communication of mass products, we will have to target small homogenous groups,” Jope said.

This was echoed by Doug McMillon, president and chief executive of Walmart. “The role of technology is converting us into a Walmart as a service and not just a store. Online and offline sales are 100% complementary for us.”

On a question on countries forcing global companies for local sourcing, the response was positive. McMillion said Walmart wants to ensure that most of its sourcing is done locally to benefit communities. Jope said 90% of the products of Unilever are locally sourced and sold.

India recently announced new rules for e-commerce companies, which demanded more local sourcing of products.

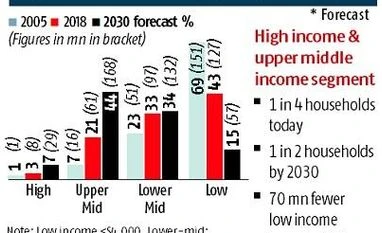

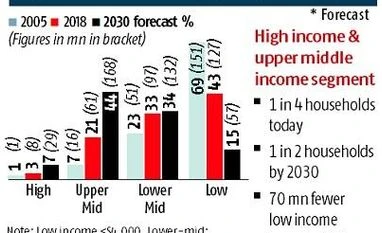

WEF in partnership with Bain and Co released a report that endorsed the positivity about rise of consumption in India. “The Future of Consumption in Fast Growing Markets: India” report says that a broad-based consumption growth will lift over 25 million out of poverty and reduce the share of households below poverty line from 15% today to 5% by 2030. “The growth will be services driven and be broad-based across 50,000 developed rural areas. This is unlike China where a handful of top cities created the growth impulse,” says Nikhil Prasad Ojha, partner at Bain & Co.

)

)