The quarter ended September saw the first sequential improvement in GDP (gross domestic product) growth in five quarters. This has improved the prospects of an export-led economic recovery in India. According to Central Statistical Office data, financial, real estate and business services, including information technology (IT) services, were the biggest growth contributors, growing 10 per cent during the second quarter. Analysts expect the export momentum to result in rising capacity utilisation and a boost to investment and consumption demand in the coming quarters.

Back-of-the-envelope calculations show export growth (net of imports) accounted for 70 per cent of the incremental growth in GDP during the September quarter. At 2004-05 prices, exports of goods and services rose 16.3 per cent year-on-year basis, the most in eight quarters. Imports were flat, growing 0.4 per cent, the least in 14 quarters.

“The sequential growth in GDP was led by export sectors, which gained from the rupee’s depreciation and the mild economic recovery in North America and Europe. In the near term, it directly raises output and the utilisation rate in export-oriented industries and their vendors and suppliers,” says Dhananjay Sinha, co-head (institutional equity), Emkay Global Financial Services. He expects higher GDP growth in the second half of 2013-14, aided by export buoyancy and better growth in the farm sector. “GDP growth seems to have bottomed out for now, but its sustainability is still doubtful, given the macroeconomic headwinds such as high inflation, the persistently high fiscal deficit and regulatory bottlenecks in many sectors,” he adds.

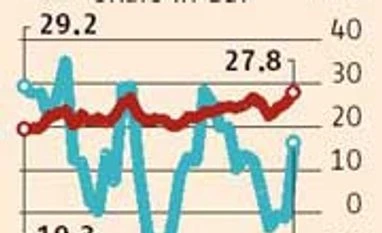

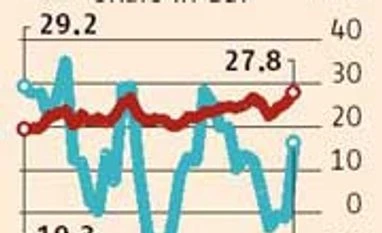

Now, exports account for 27.8 per cent of India’s GDP (on an expenditure basis), the most in about a decade. The previous high was recorded in the September 2008 quarter, when exports accounted for 26.4 per of GDP. This, coupled with the sluggish import growth, led to a sharp fall in the current account deficit.

Ratings agencies, however, aren’t surprised. “The economic growth in the second quarter has been led by a recovery in the export sector and robust growth in agriculture output. This was largely expected, given the rupee’s depreciation earlier this year and the good monsoon,” says Devendra Kumar Pant, chief economist and head (public finance) at India Ratings and Research.

Farm output (including forestry and fishery) rose 4.6 per cent in the second quarter, against 2.7 per cent growth in the first quarter and 1.7 per cent in the year-ago period. A good monsoon will translate into a bumper rabi harvest (winter crop), which will aid economic growth during the second half, besides raising rural income. It will also result in higher demand for consumer goods such as garments, tractors and two-wheelers.

Economists, however, doubt whether the buoyancy in the export and farm sectors will led to secular investment and consumption demand growth in the economy. “The recent data on the index of industrial production suggests a sporadic recovery in a handful of sectors, but there is still no sign of general growth in manufacturing. Investment demand, meanwhile, remains sluggish and unless it regains previous highs, the economic recovery won’t last long,” says Pant.

Gross fixed capital formation (proxy for investment) increased 2.6 per cent in the second quarter, against -1.2 per cent in the first quarter and 1.1 per cent in the year-ago period, though much below the double-digit growth recorded during the boom period of 2004-08. Investment demand accounted for 33.6 per cent of GDP in the second quarter, 100 basis points higher than in the first quarter, but 100 basis points lower on a year-on-year basis. At its peak, investment accounted for 36 per cent of GDP.

)

)