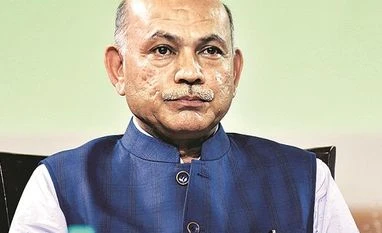

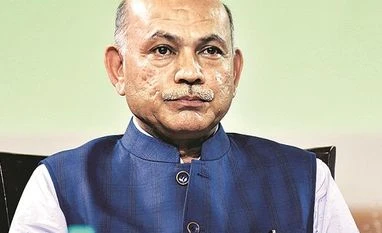

Eight months since its roll-out, the faceless assessment mechanism has proved to be a success for the income tax department, with 1.06 lakh cases being disposed off so far in a ‘glitch-free manner,’ said Central Board of Direct Taxes’ Chairman P C Mody, in an interview with Business Standard. He added that the smooth functioning has addressed industry apprehensions related to an increase in litigation and high-pitch assessment. A crucial aspect of the faceless scheme is a pointed questionnaire by the department and a to-the-point reply by the assesse, he explained.

Of the 57,985 cases picked for assessment during its pilot last year, orders have been passed in 46,822 cases. Of the 1.36 lakh new cases picked up since the launch of the scheme on August 13, the assessment has been completed for 59,552 cases so far.

The Centre launched the faceless scheme last year, which included provisions for faceless assessment, faceless appeals, and faceless penalties, in order to eliminate the physical interface between taxpayers and tax authorities and do away with territorial jurisdiction. In fact, the Finance Act, 2021 has provided for a faceless Income Tax Appellate Tribunal, which will come into effect this year.

“The theme is honouring the honest. The focus of the department is to provide good taxpayers services by being fair and clear, and resolving disputes and assessments within a given timeframe,” said Mody.

However, the faceless appeals process was off to a slow start, with only 14,743 orders passed so far, as against 4.12 lakh appeals cases. In fact, of the total orders passed, 11,322 pertain to the Vivad se Vishwas scheme withdrawal orders, and only 3,421 orders have been passed in regular appeal cases. However, Mody explained that while the faceless appeals scheme was launched on September 25 last year, orders could only start getting passed from January 2021.

“Finalising the functionalities for appeals and assignment of cases took time. The scheme had to be drafted, data had to be uploaded, then random allocation had to be made and officers had to be relocated…actual orders started getting passed from January,” said Mody. He further explained that another issue was on account of orders being manual till 2016. “All those manual orders and documents had to be uploaded,” said Mody.

)

)