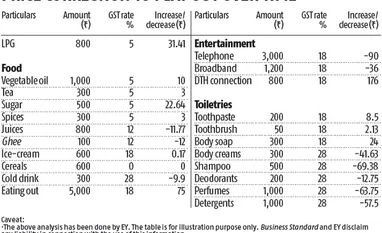

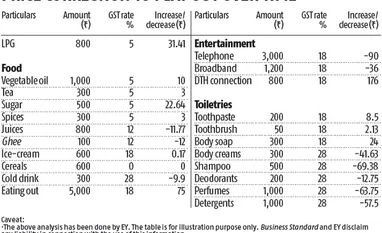

The jury is still out whether the GST will lower or increase your monthly budget. Clearly, the usage of certain goods and services will cost more compared to others. While prices of most essential commodities will see a fall, some packaged and processed food items may see an increase. If you are a big consumer of juices and ghee, your household budget, after July 1, will take an additional 20 per cent knock. And if you are a heavy user of a telephone and broadband connection, get ready to see a rise of 90 per cent and 36 per cent, respectively. On the other hand, your family can use more soaps as the decrease in tax will be 24 per cent.

According to a calculation by EY, a household may see some changes in their monthly budget as follows. The price of cooking gas cylinder, essential commodities like salt, oil, tea, sugar and spices will come down. But juices and ghee may see an increase in price.

In case of toiletries toothbrush, toothpaste and bathing soap could become cheaper, but detergents, shampoos, deodorants, creams and perfumes may become more expensive.

While eating out and cable television (DTH) would become cheaper, telephone and internet charges may see an increase.

Amit Bhagat, partner, Indirect Tax, PwC also says that while the general perception is that prices will increase, that is not necessarily the case. “Ideally the new tax structure should lead to a reduction in prices. But we have to wait to see how soon they will take effect and how they will benefit the end customer,” he says.

For instance, if a certain commodity is taxed at 12-14 per cent VAT and under GST it becomes 18 per cent, the immediate reaction is that the price will go up. But the cost to company may actually go down because it will get the input credit benefit for the excise duty that was charged. So the rise in cost to the consumer may not be significant, may even fall in some cases.

Currently, while calculating prices people are estimating the present levels of duty. For instance they are only taking state value-added tax and central excise. But they are not factoring excise, octroi and the cascading effect of tax for which companies will get input credit, Krishnan adds.

)

)