After seeing an increase of around 25 per cent in exports last month, ready-made garment (RMG) exports fell by nearly 41 per cent in October.

Exporters have attributed the drop to the fall in order bookings as ambiguities related to GST have put India in a disadvantageous position against other competing nations.

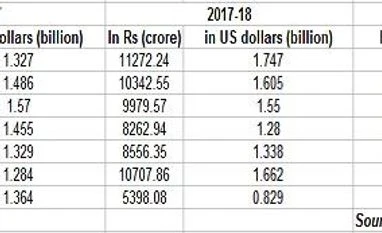

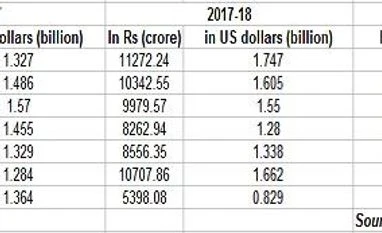

RMG exports rose to Rs 10,707 crore in September 2017 from Rs 8,583.55 crore in the same month a year ago. In dollar terms, these figures were $1.662 billion as against $1.284 billion. Of the total RMG exports, 52 per cent were in the woven segment and 48 per cent is knitwear. After a three-month gap, exports had seen positive growth.

In October, RMG exports dipped by around 41 per cent in rupee terms to Rs 5,398.08 crore from Rs 9,100.75 crore a year ago. In dollar terms, it dropped by 39.22 per cent to $0.829 billion from $1.364 billion a year ago.

FIEO Southern Region Regional Chairman and former Tirupur Exporters' Association (TEA) president A Sakthivel said that exporters could not take advantage of the positive trend in global trade due to a serious cash crunch. TEA represents knitwear exporters from Tirupur.

While referring to the difficulties faced by exporters in getting GST refund for tax paid on exports during the month of July and August, he said that irrespective of the best efforts of the department to disburse refund claims, they could not be settled in a majority of the cases due to system issues, including the need for matching various heads of different returns.

He requested the Central Board of Excise and Customs (CBEC) to come forward and immediately issue GST refunds based on details of IGST paid on exports. He added that if necessary, verification could be done at a later stage.

Sakthivel urged the Finance Ministry to reinstate the old duty drawback rate, at least until March 31, 2018, including reinstating the old Rebate of State Levies (ROSL) rates so that Indian products become competitive and take advantage of positive market trends. Alternatively, he suggested that a system that would refund all embodied taxes suffered in export products be brought in.

He also urged the finance minister to instruct the banks to provide soft loans against GST refunds receivable so that exporters can come out from under the serious financial crunch.

Exporters have also urged the GST Council to immediately refund input tax suffered on export products from July to October. They have added that in case the system is not ready, the refund may be provided based on claims by the exporters and verification can be done at a later stage.

TEA President Raja Shanmugam said that people are now becoming used to the system. In the past three months, while global demand was increasing, exporters could not cater to it due to tax-related confusion.

"Now, we don't have a choice but the GST makes our products costlier compared to other countries," said Shanmugam. He added that the September numbers are not sustainable in the current environment.

Another exporter agreed and said unless India signs a free trade agreement with European countries, exporters will be in deep trouble. Competing nations have a duty advantage, which India does not possess.

Customers have also started asking for a reduction in prices after the rupee started strengthening against the dollar. This comes at a time when the cost of doing business is increasing for exporters.

Customers are sourcing from India as part of a de-risking strategy. "The day is not far when competing nations will catch up with this trend," said a leading exporter.

RMG exports so far in FY18 )

)