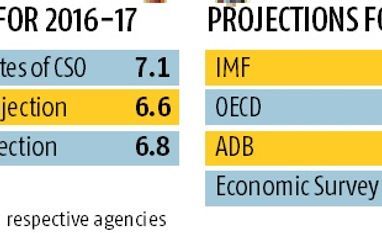

India’s economic growth will be 6.8 per cent in 2016-17 — against the official advance estimates of 7.1 per cent — due to demonetisation, if the projections of the International Monetary Fund (IMF) come true.

The IMF had earlier said growth in 2016-17 would be 6.6 per cent.

In its World Economic Outlook, released on Tuesday, the Fund retained its January forecast of 7.2 per cent growth in 2017-18, though it is lower by 0.4 percentage points than the 7.6 per cent forecast in October, before the note ban.

For 2018-19, the growth rate was projected at 7.7 per cent. The Fund advised the policymakers to recognise public sector banks' bad debts problems and capitalise them.

The Central Statistics Office (CSO) has projected India's economic growth rate at 7.1 per cent in both its advance estimates — first and the second — for 2016-17.

The IMF’s projections for the current financial year were lower than the Organisation for Economic Co-operation and Development’s (OECD's) 7.3 per cent and the Asian Development Bank’s (ADB's) 7.4 per cent. It was a bit higher than the average of the upper and lower limits of the range given by the Economic Survey at 6.75-7.5 per cent.

The Fund raised projections for world economic growth at 3.5 per cent in 2017 against 3.4 per cent broadcast in January and October, and retained the projections for 2018 at 3.6 per cent.

“In India, the growth forecast for 2017-18 has been trimmed by 0.4 percentage point to 7.2 percent (compared to the October forecast), primarily because of the temporary negative consumption shock induced by cash shortages and payment disruptions from the recent currency exchange initiative,” the IMF said.

The medium-term growth prospects are favourable, with the growth forecast at about 8 per cent due to key reforms, loosening supply-side bottlenecks, and appropriate fiscal and monetary policies, it said.

It said India’s economy had grown at a strong pace in recent years owing to critical structural reforms, favourable terms of trade, and lower external vulnerabilities.

Now policies should focus on reducing labour and product market rigidities, expanding the manufacturing base, and gainfully employing workers, it said.

Policymakers should consolidate the disinflation under way since the collapse in commodity prices through agricultural sector reforms and infrastructure enhancements, it advised.

The IMF also said the actions should boost financial stability through recognising non-performing loans and raising public sector banks’ capital buffers; cutting poorly targeted subsidies, and structural tax reforms; such as introducing the goods and services tax.

)

)