'Indian firms yet to recover from overstretched balance sheets'

IMF says a combination of high leverage and fall in profitability has affected the capacity of companies to service their debt

BS Reporter New Delhi Indian companies are in a precarious financial position, but that might well worsen going by a new study from the International Monetary Fund (IMF). The IMF warns that a combination of shocks to interest rates, earnings and exchange rates could increase significantly the debt at risk in emerging markets. This is more likely in the case of India, where the corporate sector is highly leveraged. This, in turn, could have a deleterious impact on already stretched bank balance sheets and delay pick-up in growth. Separately, the IMF had pegged India's growth to rise moderately 7.5 per cent in the current financial year from 7.3 per cent in 2014-15.

The study, titled Spillovers from Dollar Appreciation, says, "A combination of high leverage and fall in profitability on account of a slowdown in growth has affected the capacity of companies to service their debt."

The IMF pointed that India, along with Argentina, Brazil and Bulgaria, with low interest coverage ratios (ICR), which reflect a slowdown in growth, fall in corporate profitability and high leverage. ICR measures the ability of companies to service their debt burden.

According to the study, the deterioration in the capacity of firms to effectively service their debt implies that "the share of debt at risk (which they have defined as debt of firms with an ICR below 1.5) in total corporate debt has risen by around 10 per cent in 2013 relative to its five-year average, reaching 30 per cent of total corporate debt".

With the US Federal Reserve likely to raise interest rates it could lead to capital outflows to the US treasury, which will strengthen the dollar. This could lead to a weakening of other currencies, the rupee included. This will increase the rupee equivalent burden of companies' dollar-denominated debts.

The IMF argues that countries with high levels of foreign exchange leverage are more likely to be susceptible to exchange rate volatilities. It identifies India along with Brazil, Bulgaria, Chile and Hungary as susceptible, given the high level of foreign exchange debt relative to income.

The study takes into account aggregate corporate sector data and firm-level data of around 40,000 firms across the world to assess corporate vulnerabilities. In India, the data set included 4,797 firms with assets totalling $1.5 trillion.

"In a few countries (Brazil, India and Malaysia), debt at risk from state-owned enterprises could increase significantly. Debt at risk from state-owned enterprises could amount to more than five per cent of growth domestic product in India, Hungary, and Malaysia," it adds.

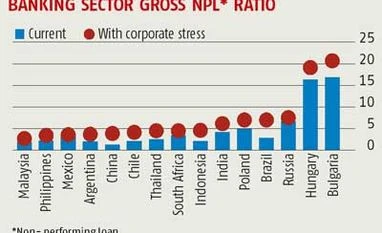

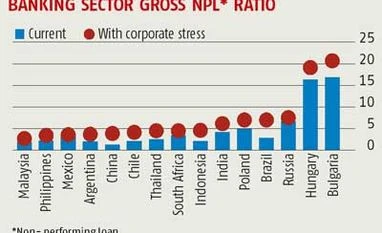

This is likely to have an adverse impact on the banking sector. Corporate default would further put pressure on their already stretched balance sheets. The IMF notes: "Bank's buffers to withstand losses from such a scenario appear low in a few countries." In the event of a default with a probability of 15 per cent, the IMF estimates that buffers comprising tier-1 capital and provisioning appear low in India, Bulgaria, Hungary and Russia, when benchmarked against Basel-III's minimum capital requirement.

)

)