Jaitley gets fiscal deficit headache reminder

June quarter's fiscal deficit level crosses half of estimate for entire financial year; tax & non-tax revenue pace a worry

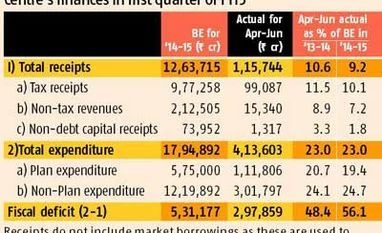

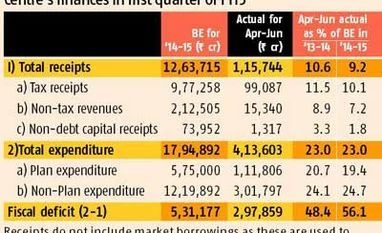

BS Reporter New Delhi The Centre's fiscal deficit crossed half the budget estimate (BE) for all of 2014-15 in the first three months of the financial year.

Finance Minister Arun Jaitley had retained the fiscal deficit target at 4.1 per cent of gross domestic product for the current financial year, as was projected by predecessor P Chidambaram, despite many economists advocating a higher amount. The deficit, gap between expenditure and receipts, was Rs 2.98 lakh crore in the first quarter, 56.1 per cent of the BE of Rs 5.31 lakh crore for 2014-15, official data showed on Thursday.

At this point of time, the deficit was 48.4 per cent of the BE last year. However, economists said the data needs to be interpreted with caution. “While inflow from various revenue streams tends to (invariably) be lower in the first quarter, particularly disinvestment, tax collections and dividends, expenditure is spread out relatively more evenly through the fiscal year, such as employee expenses,” said ICRA senior economist Aditi Nayar.

This also reflects the change of the government at the Centre, which came after almost two months of the current financial year had passed.

Nayar's statement is substantiated by the official data issued on Thursday. For instance, the government has not raised any amount from divestment, pegged at Rs 43,425 crore from direct disinvestment and Rs 15,000 crore from residual stake sale in Bharat Aluminium and Hindustan Zinc.

On tax receipts, the government could raise only Rs 99,000 crore (net of devolution to the states) in April-June, 10.1 per cent of the BE, showed figures released by the Controller General of Accounts. The collections were 11.5 per cent of BE in the first three months of the previous financial year.

“At an absolute level, the fiscal deficit in the first quarter is 13 per cent higher than in that of FY14, partly on account of unfavourable tax growth, a cause for some concern,” said Nayar.

Non-tax revenue also could not gather pace in the first quarter. These were only Rs 15,430 crore, representing only 7.2 per cent of the Rs 2.12 lakh crore for 2013-14. These accounted for 8.9 per cent in the corresponding period of 2014-15.

However, the government has managed to rein in expenditure in the first quarter, if the trend in 2013-14 is a measure. Expenditure of Rs 4.14 lakh crore was incurred in the first three months, 23 per cent of the BE of Rs 17.95 lakh crore. Expenditure accounted for the same 23 per cent of BE at this point last year.

However, non-plan expenditure was a bit higher at 24.7 per cent of BE in April-June, against 24.1 per cent in the corresponding period of 2013-14. On the other hand, plan expenditure was 19.4 per cent of BE against 20.7 per cent over this period.

Nayar attributed this to a sharp pick-up in outgo for interest payments. These stood at Rs 90,694 crore, accounting for 21.2 per cent of BE (Rs 4.27 lakh crore). These expenses had constituted 16.6 per cent of BE in the first quarter of 2013-14.

)

)