Lower fuel inflation pulls down WPI

WPI inflation stood at minus 0.85 per cent, compared to minus 0.91 per cent in February

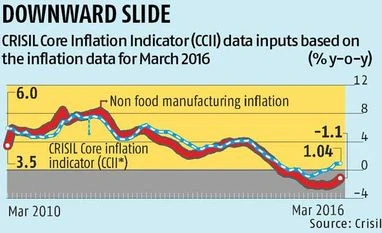

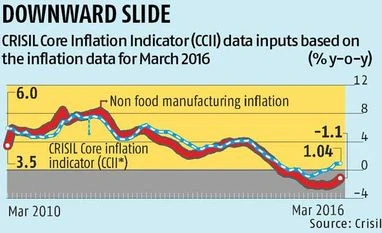

Business Standard Wholesale Price Inflation (WPI) continued to fall in March, albeit at a slightly slower rate. WPI inflation stood at minus 0.85 per cent, compared to minus 0.91 per cent in February. Food inflation rose in the month, driven by a rise in milk, eggs, meat and fish inflation, while prices of fruits and vegetables continued to fall. On the other hand, fuel inflation fell at a faster pace than last month, at minus 8.3 per cent from minus 6.4 per cent in February. Core inflation as measured by the CRISIL Core Inflation Indicator (CCII) rose marginally to 1.04 per cent from 0.96 per cent previously, driven by higher inflation in manufactured food products, beverages, tobacco, transport, equipment and parts.

Food inflation (primary plus manufactured food) rose slightly to 4 per cent from 3.7 per cent in February due to a rise in both primary and manufactured food inflation. Primary food inflation inched up to 3.7 per cent from 3.4 per cent in February, led by higher inflation in cereals with most of it coming from rice, wheat and bajra. Pulses inflation fell a tad (at 34.5 per cent in March), albeit still at a high level. Inflation in processed food (food products), which has been rising since September 2015, touched 4.5 per cent in March, on the back of a steady pick-up in oilseeds' inflation.

Read more from our special coverage on "WPI"

In the 'fuel and power' category, prices fell at a sharper rate as inflation stood at minus 8.3 per cent compared with minus 6.4 per cent in February. This was led by a fall in prices of LPG, petrol, and high speed diesel, followed by lower inflation in electricity. This was despite the rise in global oil prices for the Indian basket by 11 per cent in March. Some appreciation in the rupee in the month is likely to have reduced the rise in imported inflation in fuel categories such as petrol and diesel.

For the past few months, an interesting phenomenon had emerged in the two core inflation measures. Not only were the two showing a divergent trend but the CCII measure also turned positive since December, while the non-food manufacturing inflation measure remained negative. In March, the non-food manufacturing inflation measure stood at minus 1.07 per cent, while CCII inflation, after entering the positive zone in December, was at 1.04 per cent. The pick-up in CCII was mainly led by a rise in inflation in food products (18 per cent weight in this index), beverages, tobacco & tobacco products, wood & leather products, and transport, equipment & parts. The CCII offers a better perspective on core inflation as it negates the effect of volatile categories. It excludes base metals as their prices are mostly determined by global demand-supply dynamics and volatility in exchange rates, rather than just domestic conditions. This exclusion causes a variance between CCII and non-food manufacturing inflation. Basic metals prices continued to fall in March, with inflation at minus 5.44 per cent, compared to minus 8.07 per cent in February. As a result, non-food manufacturing inflation remained in the negative zone in the month.

)

)