The minimum import price (MIP) on steel might have propped up the profit margins of companies to some extent, but it has done nothing much to steel manufacturers’ debt-servicing abilities.

According to Crisil Ratings, MIP and the anti-dumping measures will lend a marginal fillip to the profit margins over the medium term, but companies’ debt-servicing abilities will remain weak given the indebtedness levels.

“The average domestic realisations are expected to increase marginally this financial year. This, along with a 4-6 per cent expected growth in domestic demand on the back of revival in user segments such as infrastructure and automobiles, expected decline in imports, and few capacity additions, will lead to improving operating rates,” the report had said.

In the first quarter, operating margins had improved on lower input prices, which had helped the steel industry improve operating margins by 500 basis points (bps).

Crisil’s review for the second quarter says that the earnings before interest, taxes, depreciation and amortisation (Ebitda) margins are seen up 150 bps, riding on a 2-4 per cent increase in prices.

According to Sunil Srivastava, deputy managing director, State Bank of India, with the increase in Ebitda levels, lenders are able to appropriate 5-15 per cent from each sale proceeds for at least part-interest realisation.

“Post-MIP, there has been an anti-dumping duty. This has led to stability in the market and prices have gone up,” he said.

Lenders are also seeing some renewed interest from investors for leveraged companies.

“We are seeing some interest from investors and funds. We are evaluating the interest in SDR (strategic debt restructuring) companies and for promoters desirous of such alliances outside SDR,” said Srivastava.

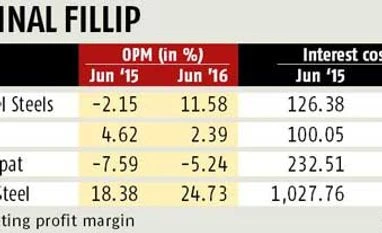

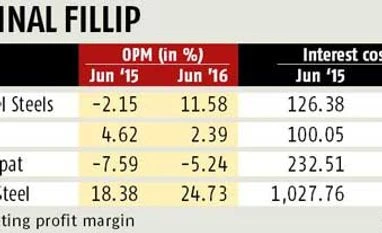

However, a look at indebted companies such as Electrosteel Steels, VISA Steel, Monnet Ispat Energy and Bhushan Steel shows that the operating profit margins at the end of June 2016 had improved for most, but the interest cost had also shot up for these firms.

For instance, the operating profit margins for Bhushan Steel had improved from 18.38 per cent in June 2015 to 24.73 per cent in June 2016. But, according to the company’s latest annual report, its indebtedness, too, has risen from Rs 39,869 crore to Rs 46,062 crore.

Nittin Johari, director (finance) and chief financial officer at Bhushan Steel, said whatever improvement in profit margins had happened would not be there in the wake of the surge in coking coal prices, a key raw material for steel. “We are back to square one,” he noted.

Coking coal prices had increased from $90 a tonne to $210 a tonne since January. Around 0.8 tonne of coking coal is required to produce one tonne of steel.

Some of the impact of the price increase was likely to kick in the second quarter performance. Moreover, NMDC has raised iron ore prices by 21 per cent.

Vishal Agarwal, vice-chairman and managing director of VISA Steel, said a long-term solution for debt restructuring was required. “MIP had helped improve capacity utilisation for the sector.”

According to R K Takkar, chairman and managing director of UCO Bank, MIP was a temporary measure. “A long-term solution would be if demand improved.”

The government had come up with a slew of trade remedial measures — tapering safeguard duty, anti-dumping and MIP — over the past year. MIP was implemented in February and has been extended twice. In the latest round, it will be valid till December 4, 2016.

“It is critical that the required impetus is provided with regard to policy issues, demand generation resulting in increased consumption. This will enable steel companies to ramp up capacities and meet additional demand, which will enable improved margins resulting in financial stability of the domestic steel industry,” said H Sivaramakrishnan, director (commercial) at Essar Steel.

Agarwal pointed out that the Reserve Bank of India (RBI) had said the guidelines for the Scheme for Sustainable Structuring of Stressed Assets would be revised. Lenders of VISA Steel had invoked strategic debt restructuring last year.

The industry is hopeful that the amendments will be favourable for the industry. The Indian Chamber of Commerce has written to RBI Governor Urjit Patel, putting forth suggestion on amendments.

)

)