Net transfer to states would fall on halt of some schemes: RBI

RBI expects all key deficit indicators to improve in 2015-16 at the aggregate level

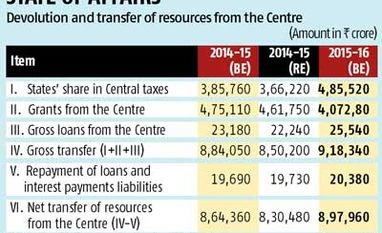

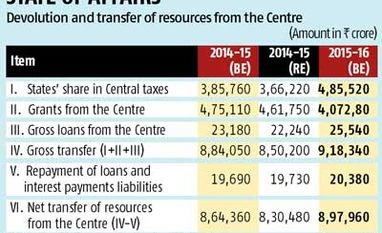

Anup Roy Mumbai The net transfer of resources from the Centre to states fell in FY15 from what was budgeted earlier. From FY16, the central transfers to gross domestic product (GDP) ratio is budgeted to decline due to discontinuation of many centrally-sponsored schemes.

In FY15, the net transfer to states were Rs 8,30,480 crore from a budgeted Rs 8,64,360 crore. While the states’ revenue receipts slowed in FY14, as the overall economic activity slackened, they were shored up in FY15 by grants in aid through enhanced transfers under ‘State Plan Schemes’, the Reserve Bank of India’s state finance report said.

Read more from our special coverage on "RBI"

The 14th finance commission had recommended increase in states’ share of tax devolution from 32 per cent to 42 per cent, but despite such higher devolution, central transfers-GDP ratio may likely decline in FY16.

The Union Budget for FY16 said funds for centrally-sponsored schemes directly transferred to district rural development agencies and independent societies would be routed through the state budgets, accounting for over 60 per cent of the total central assistance to state plans for FY15.

To tide over this, states have to do expenditure rationing, but “adverse implications for the quality of consolidation raise concerns,” the report said. The fiscal position of states deteriorated during FY14, leading to re-emergence of a revenue deficit after a gap of three years.

According to the finance commission, states’ gross fiscal deficit (GFD) to GDP ratio can reach a maximum of 3.5 per cent in a year. The RBI expects all key deficit indicators to improve in FY16 at the aggregate level.

However, despite the budgeted reduction in the GFD-GDP ratio FY16, outstanding liabilities would rise on account of the phased takeover of bonds issued by power discoms under the financial restructuring plan (FRP). The participating states will have to take over the entire bond liabilities of the discoms by FY18, which would push up their liabilities.

“In this regard, the new initiative of the government to financially turnaround discoms — Ujjwal Discom Assurance Yojana — may likely alleviate the non-performing asset problem of banks, but would increase the liabilities of participating states,” the report said.

“The consolidated revenue account of state governments is projected to be in surplus during FY16, indicative of the intent to resume fiscal consolidation. An improvement in the revenue account and a marginal decline in capital outlay is expected to provide the necessary fiscal space for a reduction in the GFD-GDP ratio by 0.5 percentage point from its level a year ago.”

)

)