The Income Tax department on May 4 activated an e-filing facility in which you can start filing returns. The department has also simplified the ITR forms to make it easier for individuals to file returns. If you still find filing this a tedious, you can approach online tax filing websites. These platforms are using technology to shorten the process and avoid errors.

Shortening the process: If you are a salaried person, in most websites you can upload Form 16 on the website. Their software automatically picks the details and fills all the fields, avoid hassle of an individual typing each and every detail manually. These platforms can also parse multiple Form 16s, if the individual has changed jobs, and compute the tax liability. “If all the required details are handy, a salaried person can file tax returns within 10 minutes,” says Chetan Chandak, head of tax research, H&R Block India. If you have capital gains on a house or shares, these websites can automatically tell you the tax liability, once you enter the date of buying and selling and price at which you bought and sold the asset.

It’s not only for the salaried. These platforms have also simplified filing returns for business owners and professionals. Explains Archit Gupta, founder of Cleartax.com: “The ITR Form for business is a lengthy form with multiple pages. To simplify, we just ask around five questions to the taxpayer. Using the answers, we fill all the relevant details automatically.”

With passing time, these platforms are becoming one-stop for all income tax related needs. In most of the platforms, a business owner can generate tax deduction at source, or TDS. Individuals can check refund status. If you have received an income tax notice, you can use their consultation services and know how you should proceed further. If there’s a mistake, you can also file revised returns. When you enter details, these websites use tax optimisers to tell you areas where money can be saved. “We also offer a vault where you can store all tax-related documents for future reference,” says Sudhir Kaushik, co-founder, Taxspanner.com.

Catching errors: These websites also use multiple methods to verify your details at each stage. They can pull your tax deductions (Form 26AS) and cross check the details that you have entered. Many individuals enter the mobile number in the field where they are supposed to state their total income. The software can detect such errors and ask you to rectify. “We have over 250 validations to ensure correctness of tax return. Thus avoiding mistakes, notices and penalties,” says Vishvajit Sonagara, founder, Quicko.com.

Assisted filing: If you need help to file taxes, these websites can put you in touch with chartered accountants (CAs). Some connect you to independent CAs, like ClearTax.com, and some have in-house experts, like H&R Block India. If you are unhappy with the expert assigned, you can request for a change.

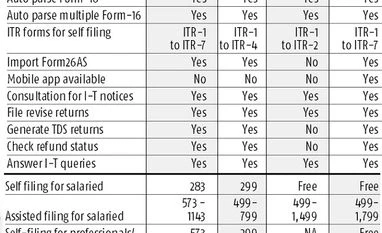

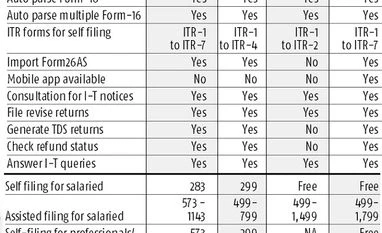

If you are self-filing returns using these platforms, some charge a small fee (between Rs 250-300) and other let you use it for free. The assisted filing plans change depending on the complexity of your returns. If your returns are simple, you can avail assisted filing between Rs 500-600. For complex cases, where there’s capital gains, multiple sources of income, one needs to shell out between Rs 1,143 and Rs 1,799. For professionals and business, assisted plans range between Rs 799 and Rs 6,500.

If you are not using assisted filing service but get stuck while filing returns, you can also opt for a plan where you can consult a CA on the phone. Such plans start at around Rs 500.

Who’s responsible for a mistake? Despite all the checks, there’s still possibility that there can be an error in filing. There has been a case where an online tax filing website made a mistake in punching the salary of an assessee. The assessing officer raised tax demand. When the case went to income tax tribunal, it said that as long as it was a genuine mistake and no mala fide intention of the taxpayer, he or she cannot be held responsible. However, always review your tax returns before it’s filed.

)

)