Panel suggests transfers from grants to tax

States had sought tax devolution at 50% of net tax receivables of Centre

BS Reporter New Delhi In spite of the Centre envisaging reduced fiscal space, the states will get a much higher share of central taxes at 42 per cent as recommended by the 14th Finance Commission report. This marks a substantial increase of 10 per cent against 32 per cent as suggested by the previous Commission.

However, during the Commission's consultations with the states, most of them had sought 50 per of net tax receivables of the Union government. Most of the revenue flow from the Centre to states should be in the form of tax revenues.

The Commission accepted the state governments’ suggestions on states-specific devolution, but arrived at tax devolution of 42 per cent. It said the Centre would have adequate fiscal room even after this much devolution.

According to the Commission’s report, states under the proposed model would receive Rs 5.69 lakh of the tax revenue in the coming financial year. For the complete five-year period, the states would receive nearly Rs 40 lakh crore.

(LOOKING BACK) The rationale behind states receiving greater portion of the pie is the concern that exclusion of cess and surcharge would deny states their right in the divisible pool. Realising that inclusion of these tax components would require Constitutional amendment, the Commission recommended higher tax devolution to states.

“We are of the view that tax devolution should be the primary route of transfer of resources to states since it is formula-based and thus conducive to sound fiscal federalism,” the report noted.

Share of cess and surcharges in gross tax revenue of the Union government has increased from 7.53 per cent in 2000-01 to 13.14 per cent in 2013-14.

According to the finance panel, chaired by Y V Reddy, it would serve the twin objectives of increasing the flow of unconditional transfers to the states and leave appropriate fiscal space for the Union to carry out specific-purpose transfers.

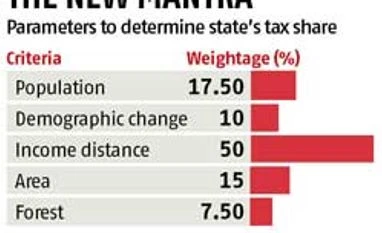

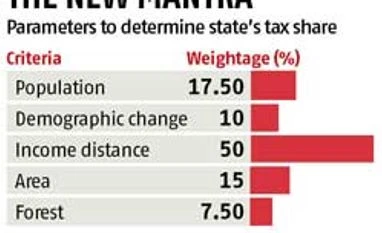

In terms of the tax revenue pie to individual states, the Commission has taken into consideration parameters such as income distance, area, population, demographic change, and forest cover.

Based on these parameters, the winning states in terms of tax revenue are Uttar Pradesh (17.95 per cent); Bihar (9.66 per cent); Madhya Pradesh (7.54 per cent); and West Bengal (7.324 per cent).

In terms of service tax, Uttar Pradesh gets the lion’s share of 18.205 per cent, followed by Bihar at 9.78 per cent.

)

)