Power generation: More is not merrier

Power cos are still reeling under subdued demand and regulatory hurdles. Third in a five-part series

Shreya Jai New Delhi The major issues which plague the Indian power sector are fuel availability, regulatory hurdles, demand-supply mismatch, financing and legal tussles. While the United Progressive Alliance (UPA) government pushed for mega power projects, the National Democratic Alliance (NDA) government has taken steps to facilitate fuel supply to the same. This has shown quick results with power generation increasing by 5.5 per cent in May 2015.

The 12th Plan period (2012-2017) has been a record-breaking year with thermal capacity touching 20,830 megawatt (Mw) in 2014-15 – which is the highest capacity addition ever in the history of Indian power sector. During the first three years of the 12th Plan period, the private sector contributed 63 per cent to the total thermal power capacity addition of 57,719 Mw. Most of it is owing to Coal India’s increase in production, international coal prices coming down, assured future supply with coal block re-auctions and clarity on gas supply mechanism.

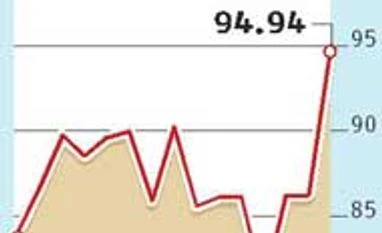

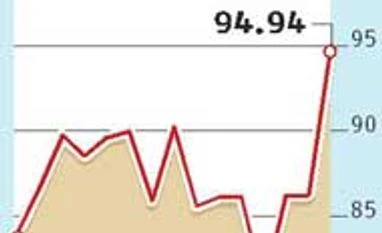

Compared to last year, the share of long-term purchases has risen to 90.5 per cent in FY15 from 89 per cent in FY14.

“Increase in coal availability led to capacity addition touching a record high with private companies contributing a major share. The sector is confident of a long-term growth trajectory. It’s the short-term purchase of power, which is under pressure,” said Rajesh K Mediratta, director (business development), India Energy Exchange.

According to latest data, in 2014-15, 3.1 billion units of electricity were lost on power trading platforms. This is where all the big talk about massive capacity addition fails. Subdued demand from financially sick power distribution companies are hurting the power supply.

“Focus on long-pending issues of fuel availability and supply logistics might be yielding immediate results. But, on power distribution side, major intervention has not commenced. The financial restructuring plan (FRP) for improving the health of state distribution utilities has not taken off and cost recovery remains an issue. Regulatory assets compounding the problem and private participation have been minimal,” said Sambitosh Mahapatra, Partner — power and utilities, PwC.

There are also projects totalling 20,000 Mw under litigation of which cost pass through is the most contested issue. Noted power companies continue to reel under regulatory issues, including state-owned NTPC. The thermal power giant saw its net profit declining to Rs 10,291 crore during 2014-15 from Rs 10,975 crore in past year. The company has on several instances mentioned that the stringent tariff regulations are hurting its profits. The provisions of ‘Tariff Regulations for the period 2014-2019’ by Central Electricity Regulatory Commission (CERC) led to reduction in power sale tariff which NTPC has contested in court of law. The other legal hurdle hurting growth of power generators is compensatory tariff or pass thorough of increased cost of fuel on the power price. The two year old case of Adani Power and Tata Power’s Ultra Mega Power Project — both in Mundra and running on imported coal is back to square one with Appellate Tribunal of Electricity investigating the matter again.

The independent power plants (IPPs) based on imported coal still don’t have any cushion in their power purchase agreements for fluctuating exchange rate and coal prices in the global market as there is no steady regulation on the same.

Adani Power which mostly sources imported coal witnessed its consolidated net loss for 2014-15 increasing to Rs 816 crore against Rs 290 crore in 2013-14. It is the largest private power producer in the country with 10,440 Mw of installed capacity. The company in its last statement said a lot is riding on the availability of domestic coal and regulatory clearances.

ICRA in its latest report on the power sector said the power generators would continue to reel under domestic coal deficit. “This would lead to dependence on costlier imports, leading to under-recovery in energy charge. CERC also is yet to issue any final order for rate compensation request for impact due to Rupee depreciation,” said ICRA.

Meanwhile with cooling of international coal prices last year, Tata Power’s consolidated operating profit for the fourth quarter 2014-15 was 28 per cent higher at Rs 1,408 crore against Rs 1,097 crore.

The 13th Plan period pipeline for thermal power projects is empty, with none of the major infrastructure firms investing in new projects. With the other parts of the supply chain beleaguered, the excitement around power generation is shortlived, warn power sector executives. The demand for power from states is subdued and distribution companies are still awaiting turnaround with Rs 2 lakh crore of losses mounting annually.

“Fuel availability and generation numbers do not portray the right picture and turnaround in the power sector is still some way off. In a leaking bucket, whatever goes in doesn’t matter, it still doesn’t hold up. The political will to reform distribution sector is still missing across states,” said Mahapatra.

)

)