The railways is exploring non-Budget funding options to implement projects, including high-speed trains, rolling stock, station development, and signalling and infrastructure development.

Apart from approaching multilateral organisations like the World Bank and the Asian Development Bank, the railways is in talks with public sector banks, including State Bank of India, Infrastructure Development Finance Company and pension and sovereign wealth funds.

This is in addition to the budgetary allocation of Rs 1.21 lakh crore for the railways in the current financial year.

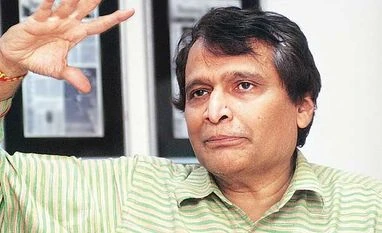

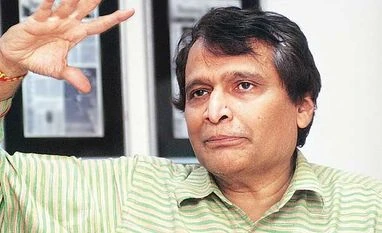

Railway Minister Suresh Prabhu at a conference organised here by the Indian Merchants Chamber said the World Bank had agreed to anchor the Railway Infrastructure Development Fund with a corpus of $5 billion over seven years. The fund will be co-anchored by pension and sovereign wealth funds.

“The railways will be the best destination for pension and sovereign wealth funds. Their capital is safe, as there is permanent revenue and it is increasing,” he added.

He said projects capable of repaying debt would be financed through public-private partnership. Prabhu said the Japan International Cooperation Agency had agreed to provide loan at 0.1 per cent interest for a 50-year tenure and a 15-year moratorium for the Rs 1 lakh crore Mumbai Ahmedabad bullet train. The implementation period for the 508-km project is slated till 2023. Life Insurance Corporation has provided the railways a Rs 1.50 lakh-crore loan for 30 years, of which Rs 10,000 crore has been used so far.

Prabhu said redevelopment of railway stations would be carried out in an integrated manner to house trains, buses, rickshaws and taxies. “This is a major opportunity and it is going to be a massive exercise. Two weeks ago, an agreement was signed with the Gujarat government and the Surat Municipal Corporation for the redevelopment of the Surat station,” he added.

ON TRACK - Railways is in talks with SBI, Infrastructure Development Finance Company and pension and sovereign wealth funds for funds

- World Bank had agreed to anchor the Railway Infrastructure Development Fund with a corpus of $5 billion over seven years

)

)