Removing last items from MSME list to boost production

BS Reporter New Delhi The government recently dereserved the last 20 of the items that had been kept aside for exclusive production by micro and small enterprises, paving the way for their large scale production and removing hurdles in the way of these enterprises to become bigger.

This move, says Yogesh Dixit, executive vice-president and head SME at CARE, "should be seen as part of a broader trend. Many items had already been dereserved and this was bound to happen". The government had reserved these items for MSMEs to protect small and medium enterprises from competition but had over the years whittled down the list of items reserved from over 800 to 20. The items that have been dereserved range from pickles and chutneys to bread, laundry soap, steel almirahs and chairs, and stainless steel utensils.

An advisory committee, which recommended the scrapping of the last list of 20 items reserved for micro and small enterprises, had noted that "with import liberalisation, all remaining items are allowed for imports. Thus, there is no justification for continuation of reservation of manufacturing in the MSE sector since such reservation may inhibit the possibilities based on technologies and economy of scale vis-à-vis the imported items."

As the definition of what is a small unit is restrictive, companies were unable to expand production and acquire technology to scale up. Removing these items from the list will allow them to scale up. Big companies, too, will be able to take advantage of this opportunity, using their financial muscle to set up large units.

This latest move, according to Soumya Kanti Ghosh, economist at State Bank of India, "is likely to introduce more competition and is thus a positive development. The impact will, however, be felt in the long run."

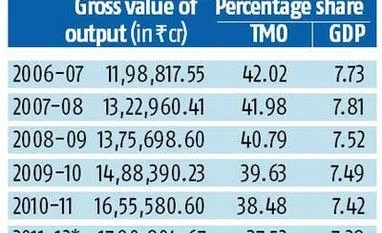

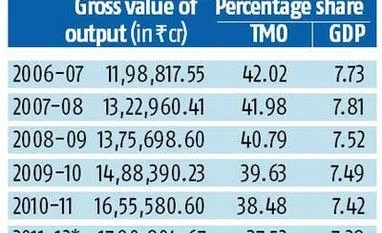

India has over 46 million MSMEs employing roughly 100 million workers. The sector accounts for 37 per cent of the country's manufacturing output and around 7 per cent of the gross domestic product. Central to the success of the "Make in India" campaign is the growth of this sector. MSMEs not only help in industrialising rural and backward areas, thereby, reducing regional imbalances, but are also complementary to large industries as ancillary units.

Growth of the MSME sector is widely believed to be critical to generating employment. The sector employs the largest proportion of the labour force after the agricultural sector. According to Dixit, because of the sector's employment generation capabilities, it deserves special attention.

This latest move by the government, he adds, should be seen in conjunction with the launch of the Micro Units Development Refinance Agency to extend credit to small and medium enterprises. As access to cheap and reliable credit is a big stumbling block for these units, the move to set up this agency could help increase resources that will flow to the sector. This scheme with a corpus of Rs 20,000 crore, can lend between Rs 50,000 and Rs 10 lakh to small entrepreneurs.

)

)