Reserve Bank of India (RBI) Governor Raghuram Rajan’s assertion that the rupee was fairly valued might have its roots in the economic reality that the country is facing and not necessarily taking into consideration the numbers put forward by indices that measure the domestic currency’s strength. The Real Effective Exchange Rate (REER) shows that the rupee should depreciate sharply, but that won’t be helpful for an import-dependent India where the quantum of exports easily gets dwarfed by the quantum of imports. A strong currency helps in fighting some of the import-led inflation.

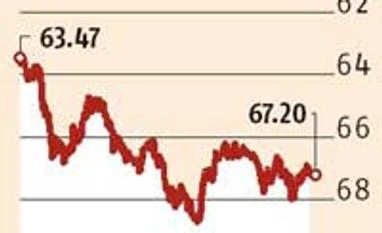

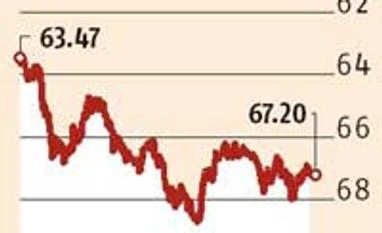

Theoretically, going by the metrics alone, the domestic exchange rate needs to be at 74-75 a dollar level to be on a par with its export competitors. Compared to that, the rupee closed at 67.20 a dollar on Monday.

“Yes, the Real Effective Exchange Rate (REER) shows that the rupee is overvalued. But, the rupee should remain strong to lower import bill and therefore, the present exchange rate can be termed to be fairly valued,” said Jayesh Mehta, head of treasury at Bank of America Merrill Lynch.

“Gold import bills are coming down because of a clampdown on corruption, oil prices are low and foreign direct inflow is strong. If the rupee does not strengthen now, when will it ever do so?” asked Mehta.

The concept of REER is used to gauge a currency’s strength vis-a-vis its trading partners or export competitors after adjusting for inflation, expressed as an index. The normal level is 100 and anything above indicates overvaluation.

REER is expressed in a six-currency basket, taking into account India’s major trading partners — the US, the Eurozone (comprising 12 countries), the UK, Japan, China and Hong Kong. Also, a 36-currency basket that takes into account a wider gamut of India’s trading partners and export rivals is also formulated.

On a 36-currency basket, the rupee’s trade-based REER index was at 110.68 in June, down from 111.32 a year ago. This indicates that the rupee indeed has depreciated vis-a-vis a variety of its trading partners. On an export basis, REER was 112.92, against 113.87 a year ago, indicating that the rupee has bettered on its competitiveness, if only mildly.

Another concept called Nominal Effective Exchange Rate (NEER), which strips the inflation differential between trading partners, is used to gauge the fair value of rupee. And these concepts, instead of just the market level of exchange rate, are increasingly becoming important metrics for currency valuation at a time. In China, for example, the government does not take into account the spot rate, but REER is the all important gauge.

“Given volatile cross-currency movements, the NEER and REER have become important metrics for currency valuation,” said Saugata Bhattacharya, chief economist at Axis Bank Ltd.

“These, however, need to be interpreted with due caution. Rather than absolute levels, comparison with past trends as well as cross-country position is useful determining valuation," Bhattacharya said.

In a speech on March 12, RBI Governor Raghuram Rajan had said that to retain competitiveness, “the rupee has to depreciate by the inflation differential vis a vis a trading partner.” The inflation differential between the developed country (India’s export destination) and India is roughly four per cent. Therefore, the currency ideally needs to depreciate by four per cent every year.

However, according to RBI’s own calculation, the country’s productivity differential with its trading partners (how efficiently India produces similar goods) works out to around 1-1.5 per cent.

Therefore, the local currency should depreciate by 2.5-3 per cent per annum for the rupee to be truly on a par with its competition.

That is not the case now as the rupee had depreciated only 1.55 per cent in a year. Perhaps comforting, is that India’s nearest competitors have seen their currencies appreciate against the dollar by a significant margin. Most of India’s competitors, except China and Mexico, have seen their currency appreciate against the dollar and that explains the moderation in REER numbers.

)

)