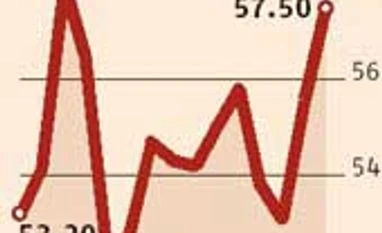

In January, the services sector grew at a brisk pace, with the widely-tracked Purchasing Managers’ Index (PMI) rising to a year’s high of 57.5 points, against 55.6 points in the previous month.

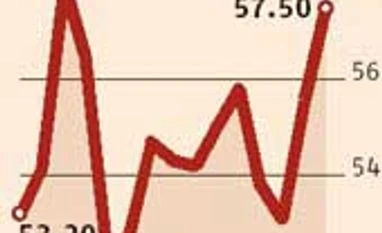

PMI for manufacturing, however, stood at a three-month low of 53.2 points, against 54.7 in December. Combining both, the HSBC composite PMI stood at 56.3 points, unchanged from December. The overall rate of expansion was the “joint fastest” (December and January) in 11 months, financial information firm Markit Economics, which compiled the PMI data, said in a statement.

PMI reading of more than 50 points shows expansion, while one below 50 indicates contraction.

Services PMI for January was below that in January 2012 (58 points). India’s services sector grew 7.88 per cent in the quarter ended March, 2011-12. Growth in the sector in the year-ago period stood at 10.64 per cent.

Economists say services PMI should be considered a broad barometer of India’s services sector and drawing any one-to-one correlation with official data would be a mistake. This is because PMI is based on a survey of private companies and is a month-on-month calculation, while official data is annual.

For the PMI index, about 350 companies in the services sector and about 500 in the manufacturing field are surveyed.

In November, PMI for services stood at a three-month low of 53.1 points. In December, it rose to a three-month high.

Speaking to Business Standard, CARE Ratings chief economist Madan Sabnavis said, “The fluctuation in PMI services index is largely due to the surge in banking activity in the recent past. More banking activity happened in January, compared to December, because this is the last quarter of financial year 2012-13.”

In the fourth quarter of 2011-12, too, financing, insurance and allied categories rose 10 per cent, while the two other segments in the sector---trade, hotels, transport and communication; and community, social and personal services--grew seven per cent, according to official data.

In the first half of 2012-13, growth in gross domestic product stood at just 5.4 per cent, against 7.3 per cent in the corresponding period of the previous financial year. Many economists expect a recovery would be seen in the second half, particularly in the last quarter.

In January, private sector output had recorded a sharp rise. Growth in new orders in the services sector stood at an 18-month high; growth in new orders in the private sector was at an 11-month high. During the month, the backlog of work at private sector companies saw a marginal rise. This was largely due to growth in production and shortage of power, said those participating in the PMI survey.

“Services sector activity continued to pick up pace, led by a faster inflow of new business. With increased hiring, the companies broadly managed to contain the rise in backlogs,” said Leif Eskesen, chief economist for India and the Association of Southeast Asian Nations at HSBC.

In its January 29 monetary policy review, the Reserve Bank of India had cut the repo rate and the cash reserve ratio by 25 basis points each, after Wholesale Price Index-based inflation fell to a three year low in December.

“Inflation readings held broadly steady, with fuel, raw material and labour cost pressures still simmering. These numbers underscore the need for RBI to approach policy easing with caution,” Eskesen said.

)

)