Tears at onion dehydration industry

With unseasonal rain spoiling crop, mandi prices soar to well above what the export-dependent sector can afford; units cutting or stopping output

Vimukt Dave Ahmedabad The onion dehydration industry says much of it faces the prospect of closure due to a steep rise in onion prices.

Reduced supply because of decrease in output and unseasonal rain compromising the crop’s quality in major producing regions have pushed up prices.

Dehydration units generally commence production from January and continue till July. Shipments are in the same period. This year, however, with the steep price of raw onion raising the production cost of the dehydrated product, demand from international buyers have been diverted to China and Egypt.

Industry sources say 10 kg of fresh onion gives a kg of dehydrated onion, as the commodity’s water content is 90 per cent. When put back in water, the kg of dehydrated onion turns into 10 kg.

“Our industry is fully dependent on global demand and this is a crucial period for us. The scenario is very grim on account of the high price of raw onion,” said Kirit Mehta, president, All India Dehydration Association (AIDA).

Total production of dehydrated onion in India was about 65,000 tonnes in 2014 and the country exported about 55,000 tonnes. Russia is usually the main buyer, with nearly 40 per cent of the total shipment. The European Union and America are other major buyers.

According to the industry, output is likely to be around 25,000 tonnes this year. About 4,000 tonnes has been exported this year, compared to the 17,000-20,000 tonnes last year during the corresponding period.

Of the 75-odd onion dehydration units in India, around 65 are in Mahuva taluka of Bhavnagar district in the Saurashtra region of Gujarat. Mahuva is the biggest arrival centre for onion in the state.

The present price is Rs 12-17 a kg in the wholesale market, much higher than the viable rate for the dehydration industry. The price has not gone below Rs 10 over three months and for the industry, anything over Rs 7 a kg for raw onion is bad news.

Mehta stated, “About 50 units have stopped production because of paucity of demand. The high rate of raw onion leaves us uncompetitive in the global market.”

Currently, Indian dehydrated onion is quoted at $2,200-2,600 a tonne. With 10.33 per cent export duty, the final cost touches $2,870 a tonne. China offers the same product in $2,400-2,500 and Egypt at $2,200-2,600 a tonne.

Vitthalbhai Koradiya, managing director of Maharaja Dehydration at Mahuva, said: “Quality is the biggest issue this year, as unseasonal rain had damaged the kharif onion crop in Gujarat and Maharashtra, which has raised the price.”

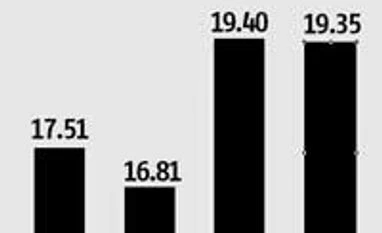

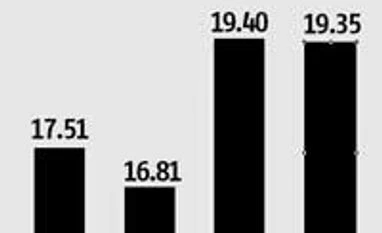

Data compiled by the National Horticultural Research and Development Foundation suggests production at 19.35 million tonnes in the 2014-15 crop year, slightly less than the 19.4 mt the previous year. Industry sources said a huge quantity of the current crop had been damaged, mainly in Maharashtra and Gujarat due to unseasonal rain. The other major producing states are Madhya Pradesh, Karnataka and Bihar.

“The winter crop will soon arrive in the market but the high price and quality issues are likely to continue because of damage following unseasonal rain,” said Asgar Chattariya, secretary, AIDA.

While global demand is static, domestic supply of dehydrated onion products has remained normal. According to an official of Rajkot-based Balaji Wafers, which utilises dehydrated onions to manufacture some of its products, their demand has been met without any interruption from suppliers.

)

)