The Odisha government’s move to double the electricity duty for captive power plants from 30 paise a unit to 60 paise a unit is likely to hit power-intensive metal processing industries.

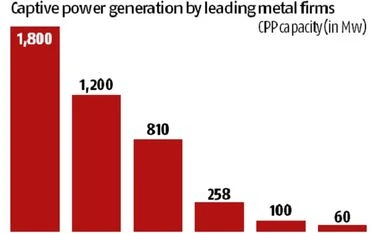

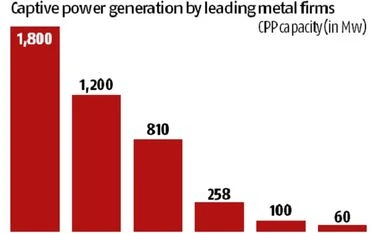

The aluminium and ferrochrome producers like Vedanta, Nalco, Hindalco, Jindal Steel and Power, Utkal Alumina, Indian Metals and Ferro Alloys, Navbharat, etc, for which power accounts for nearly half the input cost, are dependent on their captive generation plants (CGPs) to keep their cost of production in check and be competitive in the global market.

But the proposed hike in electricity duty for CGPs, which will make it costlier than the rate of levy collected on the power sourced from distribution companies, is expected to increase the cost of production of aluminium by Rs 4,000-5,000 a tonne and that of ferrochrome by at least Rs 1,000 per tonne.

Odisha has half the nation’s aluminium capacity and nearly 80 per cent of the ferrochrome capacity.

The electricity duty for CGPs was increased from 12 paise a unit to 20 paisa in 2001 and then subsequently revised to 30 paisa a unit in 2015. However, in an amendment to the electricity Act in November, 2016, the Odisha government kept the option open to increase the electricity duty for CGPs up to Rs 2 a unit.

“Aluminium being a power guzzling industry, we had set up a captive power plant with an aim to access cheaper power. The capital investment in a large size thermal power plant is about Rs 5 crore a megawatt (Mw). We made substantial investment on our captive generation. Now, the advantage will be taken away by increase in the electricity duty,” said an official of an aluminium company wishing not to be named. Aluminium requires approximately 15,000 units of power for one tonne of metal while energy uses for ferrochrome units comes to about 4,000 units a tonne.

Drawing a comparison between CGPs and Independent Power Producers (IPPs), the official said, IPPs who get preference of land, water and allocation of coal at reserve price do not pay electricity duty as the same is charged to consumers directly by the state-owned bulk power supplier GRIDCO or the distribution companies (distcom). IPPs also get benefit of FSA and assured supply of coal whereas CGPs source coal through auction or private arrangement.

)

)