Weavers reel under post-GST hike in yarn prices

The price hike has been caused by rising raw material prices such as PTA and MEG

)

Explore Business Standard

The price hike has been caused by rising raw material prices such as PTA and MEG

)

"There is still uncertainty in the industry since registration process is still going on. Weavers, processors and traders are not in the position to buy or sell. At such a time, a price hike in raw materials is having a significant impact on our input costs as well as margins," said Ashish Gujarati, president of Pandesara Weavers' Association in Surat.

Unlike the pre-GST prices, the post-GST ones will see an additional 18 per cent levy on powerlooms and processors, which the latter have to claim through input tax credit. However, on account of excess input credit accumulation and the RCM, due to lack of registered job workers in the value chain, powerlooms and processors have to bear the additional cost themselves. Hence, a Rs 2 per kg hike in yarn prices will attract an additional 18% tax, which for now might not be got back through input credit.

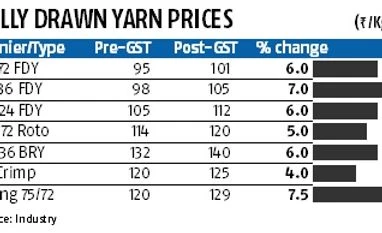

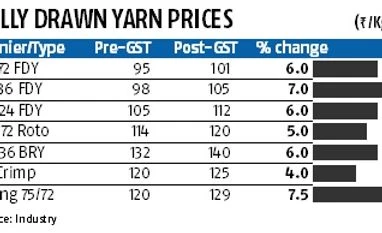

Prices of yarn in different variants of denier have risen in the recent past. For instance, while the 75/72 denier FDY has seen prices rise by six per cent from a pre-GST Rs 95 per kg to Rs 101 per kg, that for 70/36 FDY has risen by seven per cent, up from Rs 98 per kg to Rs 105 per kg. Prices for 80/72 Roto, 50/24 FDY, and 50/36 BRY have risen by five, six and six per cent, respectively, to Rs 120 per kg, Rs 112 per kg and Rs 140 per kg.

"What spinners have done is that as the market opened after a lull due to GST implementation, they have taken advantage of the buzz in demand by hiking the prices. This is profiteering," Gujarati said.

However, say yarn manufacturers, prices have risen on account of rising crude oil prices, as explained earlier, and have been seasonal. "It is a periodic exercise yarn makers engage in from time to time. It is not related to a post-GST market scenario," said O P Lohia, chairman of Indo Rama Synthetics, a leading synthetic yarn maker.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Aug 02 2017 | 2:00 AM IST