30 of 50 banks may not meet capital adequacy norms: RBI

Financial Stability Report says NBFCs perform better than banks

Nupur Anand Mumbai The Reserve Bank of India (RBI) has raised concerns over the capital adequacy ratio of many lenders (30 of 50), saying they might not be able to meet the norms under extreme scenarios.

In its Financial Stability Report, it said this ratio doesn’t seem threatened for now but could slip below the required level if there’s a surge in bad loans.

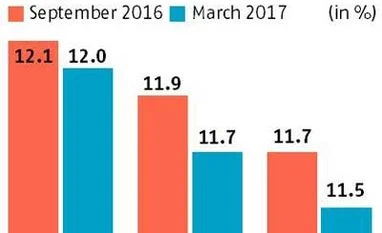

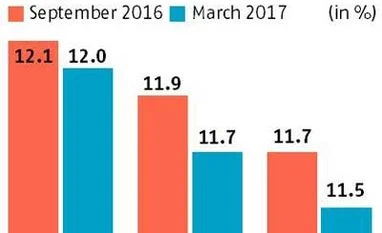

Tests conducted by RBI suggest that under a baseline scenario, gross non-performing assets (NPAs) could rise to 8.5 per cent of the total by March 2017, from 7.6 per cent in 2016. However, if banks’ asset quality faces any severe stress, it could rise to 9.3 per cent.

Public sector banks are a particular concern. The report says non-banking financial companies (NBFCs) are doing better. It noted the aggregated balance sheet of the NBFC sector expanded by 15.5 per cent over a year, as of end-March. And, gross NPAs fell to 4.6 per cent, from 5.1 per cent in September 2015.

Also, says RBI, while all in the banking system are focusing on improving the usage of technology, the system needs tighter security.

“The solution for addressing cyber threats gets compounded, given their cross-border reach, pervading different legal jurisdictions… Increased levels of hacking threats and distributed denial of service attacks have the potential for causing significant disruptions in the services of these ventures, apart from the risk related to sensitive customer information and cyber fraud,” added the report.

)

)