Asian currencies have best week in 7 months on fund inflows

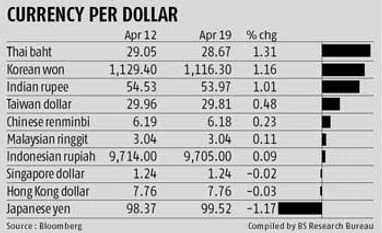

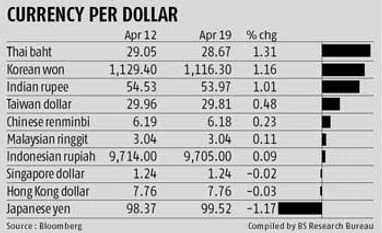

Bloomberg Taipei Asian currencies had their best week in seven months, as Japan's monetary easing spurred inflows into the region's assets, and China's central bank said it would widen the yuan's trading band.

The Chinese currency rallied the most this week since October and touched a 19-year high of 6.1723 on April 17, the same day state-run media reported the limit would be expanded.

The baht reached a 16-year high yesterday, as Bank of Thailand Governor Prasarn Trairatvorakul said the currency has started to move beyond its fundamentals. Global funds bought $1.7 billion more local sovereign notes than they sold this month, Thai Bond Market Association data show.

Elsewhere in Asia, Taiwan's dollar rallied 0.5 per cent this week to NT$29.84 against its US counterpart.

The Philippine peso rose 0.5 per cent to 41.06, Indonesia's rupiah was steady at 9,709, while Vietnam's dong slipped 0.2 per cent to 20,900. India's rupee strengthened one per cent to 53.9725 through April 18. Financial markets were closed in the country for a public holiday yesterday.

Beyond fundamentals The Bank of Japan (BoJ) said April 4 it would buy 7.5 trillion yen ($76 billion) of bonds per month. BoJ board member Ryuzo Miyao said April 18 that he expects investors based in the world's third-largest economy to buy more foreign debt. The baht has strengthened 6.8 per cent against the dollar this year, the most among Asia's 11 most-traded currencies.

"The amount of inflows into Thai bonds is so big, while there is growing speculation Japanese investors will send more money abroad," said Shigehisa Shiroki, chief trader on the Asian and emerging-markets team at Mizuho Corporate Bank. in Tokyo. "An economic recovery in Japan due to these policies will also help Thailand, as Japan is one of its major export destinations."

The won had its biggest weekly gain in two months, as tensions with North Korea eased after the US agreed to coordinate with South Korea, China and Japan to draw the country into nuclear talks.

The yuan's trading band is likely to be increased "in the near future," People's Bank of China Deputy Governor Yi Gang said April 17 in Washington, where finance chiefs from the Group of 20 nations are meeting to discuss exchange-rate policies.

Yuan band

The yuan is currently allowed to fluctuate a maximum 1 percent either side of the central bank's daily fixing. The last expansion took effect on April 16, 2012. UBS AG said in an April 18 research note that the next move may be announced by Sunday to coincide with the first anniversary as well as the G-20 talks. JPMorgan Chase & Co said a revision is more likely in 2014.

"It's not a good time to widen the trading band given that capital inflows are big and pressure is on the appreciation side," Zhu Haibin, JPMorgan's chief China economist, said in an April 18 interview in Shanghai. "If you widen the trading band now, it will trigger more capital inflows and people would expect further appreciation."

)

)