Axis Bank’s top management has decided to take home a reduced variable pay, as the lender’s performance came under pressure in the last financial year due to mounting bad loans.

“The top management will take a cut in the variable pay of anywhere between 20 and 50 per cent. The quantum will depend on various factors, including their role and the departments they work for,” said a top Axis Bank official.

Apart from the top management that includes about 100 employees, the rest of the employees in the bank will remain insulated.

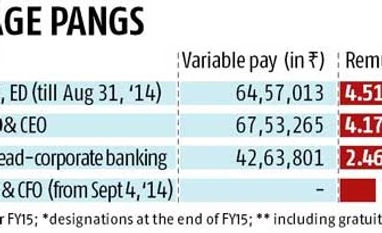

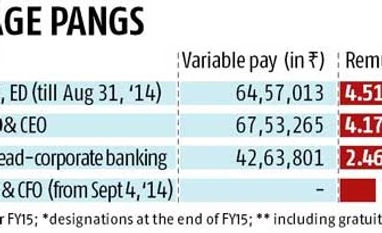

At the end of the quarter ended March, the total employee base stood at 50,135. According to bank’s FY15 annual report, the Shikha Sharma, managing director and chief executive officer, received a variable pay of Rs 67,53,265.

The decision to take a cut in the variable pay came after the lender reported a decline in its net profit, after 46 quarters, in fourth quarter of last financial year.

Going ahead, the management expects this financial year to not be significantly better as pressure on asset quality may continue and the credit growth, especially on the corporate side, continuing to remain sluggish.

According to the bank’s last year annual report, the variable pay is linked to corporate performance, business performance and individual performance and ensures differential pay based on the performance levels of employees.

“The remuneration for the management and whole-time directors will include a significant variable pay component, which will be tied to the achievement of pre-established objectives in line with bank’s scorecard, while ensuring that the compensation is aligned with prudent risk-taking,” added the FY15 annual report.

In fact, Axis Bank is not the only one; even ICICI Bank management has decided to not take home any bonus for the last financial year. According to sources, the total number of employees in ICICI Bank that is likely to be impacted stands at around 800.

It is also believed that the top-rung management at public sector banks may also not be awarded any bonus this year as they have been struggling with pressure on asset quality that in turn has impacted profitability.

Prior to this, even during the financial crisis of 2008-09, some banks’ management had taken the call of either forgoing the bonus and stock options, or taking a cut.

)

)