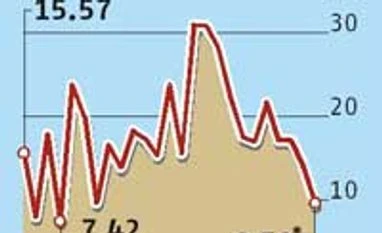

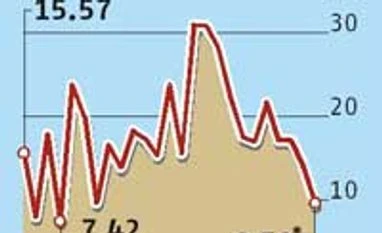

Bank credit growth likely to fall to 20-year low

Meanwhile, for the fortnight ended March 20, deposits grew 11.42% y-o-y

BS Reporter The economic slowdown and high lending rates of banks could lead to credit growth falling to levels seen 21 years ago. Data from the Reserve Bank of India (RBI) released on Wednesday showed bank credit grew 9.5 per cent in the fortnight ended March 20. The last time the growth was lower than this was March 1994 (7.42 per cent).

For the fortnight ended March 20, deposits grew 11.42 per cent year-on-year.

“Economic activity is yet to pick up in a meaningful manner, particularly as far as greenfield projects are concerned. Big-ticket credit demand is yet to be seen. But if we compare credit growth of about nine per cent with Wholesale Price Index-based inflation data of -two per cent, it might tell you credit growth has not been too bad,” said Shubhada Rao, senior president and chief economist, YES Bank.

This year, RBI has cut the repo rate (at which banks borrow from the central bank) twice (by 25 basis points each). However, the lower interest rate hasn’t been transmitted as expected.

T M Bhasin, chairman and managing director of Indian Bank and chairman of Indian Banks Association, said while substantial demand has been seen in segments such as retail and small and medium enterprises, credit growth in the case of commercial and large companies was weak in 2014-15. It is expected the situation will improve in the second quarter of FY15-16. The housing and construction sectors are expected to drive the improvement.

For the week ended March 21, the base rates of banks stood at 10-10.25 per cent; borrowing through private placement of corporate bonds or commercial papers is a cheaper option for companies. “Bank rates were higher, while raising funds through private placement of bonds or commercial papers was cheaper. Foreign institutional investors were interested in buying bonds issued by companies because the limits on government securities were exhausted. Even high net worth individuals and fund houses invested money in corporate bonds and commercial papers,” said Ajay Manglunia, senior vice-president (fixed income), Edelweiss Securities.

Tentative data from PRIME Database show fund-raising through private placement of bonds increased 31.5 per cent in 2014-15. After the rate cuts by RBI, the cost of borrowing through bonds fell sharply.

)

)