BOB cuts base rate by 25 bps, SBBJ by 15 bps

New rates effective May 6; with this, 21 of 91 scheduled commercial banks have reduced base rates

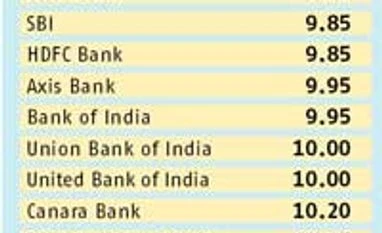

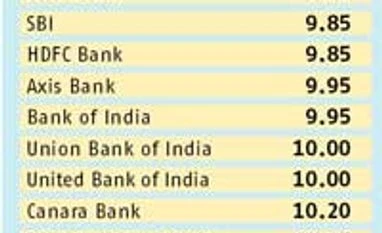

BS Reporter Mumbai Two public sector lenders — Bank of Baroda (BoB) and State Bank of Bikaner & Jaipur (SBBJ) — have cut their base rates, the benchmark used to price loans. While BoB reduced the rate by 25 basis points to 10 per cent, SBBJ, an associate unit of State Bank of India, cut it by 15 basis points to 10.10 per cent.

The revised rates would be effective Wednesday, the banks said in a filing with the BSE.

Last week, Bank of India had reduced the base rate by 25 basis points to 9.95 per cent.

BoB and SBBJ are among banks that have taken long to reduce the key lending rate. The Reserve Bank of India (RBI), as well as the government, had flagged the delay in or lack of monetary transmission (passing on the lower cost of funds to customers).

A few banks, including State Bank of India, ICICI Bank and HDFC Bank, had reduced the rate on April 7, when RBI kept the repo rate unchanged in its monetary policy review.

Since January, RBI has cut the repo rate twice, by 25 basis points each. The rate now stands at 7.5 per cent. According to finance ministry data, following the reduction in repo rate, 21 (four public sector banks, six private banks and 11 foreign banks) of the 91 scheduled commercial banks have reduced base rates by 10-50 bps each, as of April 15.

During the same period, the weighted average lending rates on fresh rupee housing and vehicle loans sanctioned by banks have fallen 8-53 basis points.

)

)