Case for further interest rate cut tomorrow

Widening arbitrage window for dollar-carry traders attracting more hot money in debt

Rajesh Bhayani Mumbai Despite the Reserve Bank of India having reduced its prime lending rate, the repo, on January 15, there is a case for a further cut of 25 basis points when it announces the last monetary policy review of financial year 2014-15 on Tuesday.

While the fundamentals were improving for some time, the rate cut in January was also to shrink the arbitrage window which was attracting hot money in Indian debt. This time, RBI can cut rates to reflect the improved fundamentals and to further shrink the arbitrage window. Most banks have not reduced their lending rates after RBI's cut. They are waiting for the policy announcement.

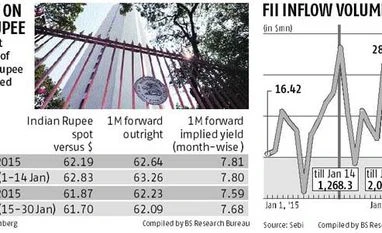

"The biggest dilemma for RBI in cutting rates was an increase in the dollar carry trade," explains a source privy to the RBI thought process. A large part of carry trade money has been coming into debt. In this financial year so far, nearly $29 billion has been invested by foreign institutional investors in Indian debt. The country doesn't need that kind of hot money - the moment the attractiveness of carry trade in the form of shrinking arbitrage reduces to an unviable level, foreign institutional investors (FIIs) will start withdrawing the money. In June 2014, such a withdrawal of $5 billion in a single month led to a sharp fall in the rupee's exchange value.

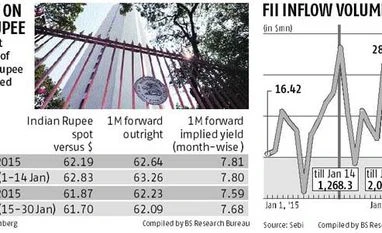

RBI was hesitant to cut rates because the moment India's bond yields fell and if the US started raising rates, the debt investment could have reversed. However, after the rate cut on January 15, for the next fortnight, FIIs pumped a further $2 bn in Indian debt because the arbitrage window had expanded due to a risel in the rupee exchange rate against the dollar and hedging cost. In the last fortnight of January, the rupee appreciated by 1.9 per cent and the forward premium fell by 12 basis points. Put together, these had made Indian bonds attractive for carry trade investors. If RBI further cuts rates on Tuesday, said a banker, "this arbitrage window can be further shrunk".

If this theory is accepted, RBI will cut rates this time because of the fundamentals. The current account is estimated to be in surplus in the December and March quarters, inflation is 0.1 per cent and industrial production is on a revival path, said the source quoted earlier. On the other front, the US Federal Reserve said last week it would adopt a 'patient' approach in raising of rates. The risk of outflow if there's a dollar carry trade reversal has for the time being been delayed.

)

)